Essential Insights:

- Michael Saylor asserts that if $MSTR’s stock price drops to $1, the company will reacquire its shares and intensify its Bitcoin holdings.

- Currently, the company’s strategy encompasses 580,250 BTC, valued at over $40.6 billion, with the potential to leverage market movements for strategic advantage.

- Saylor predicts a mainstream Bitcoin era is imminent, and reaching a $1 million per BTC could become feasible if institutional investors allocate just 10% of their assets to it.

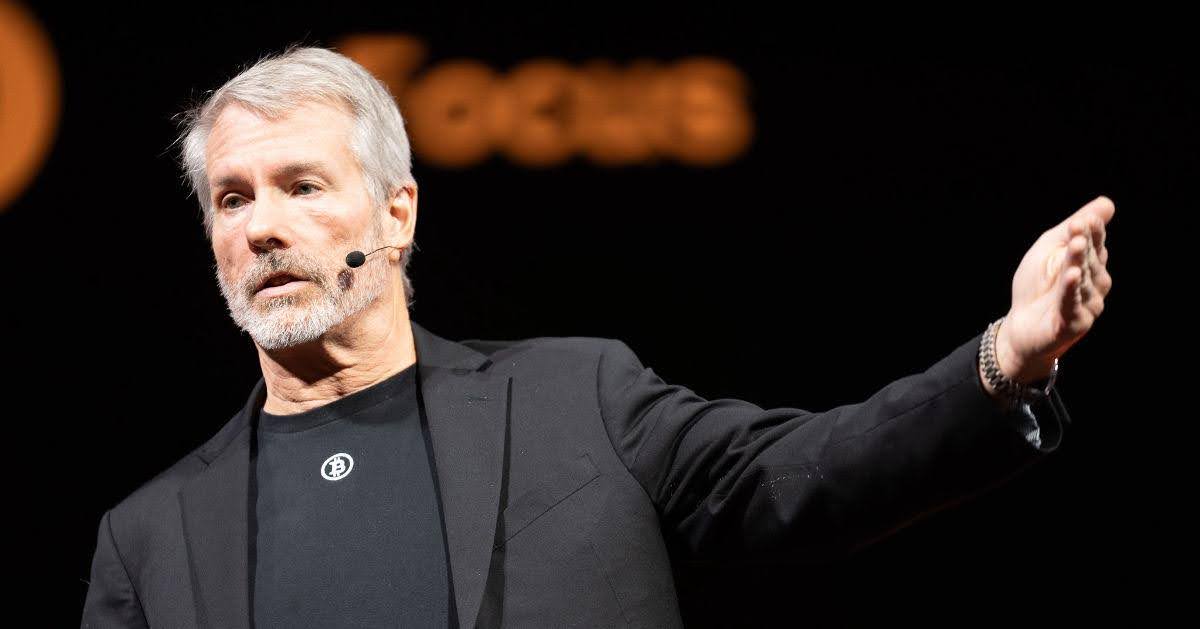

At the recent Bitcoin 2025 conference in Las Vegas, Michael Saylor, the Executive Chairman of Strategy (formerly MicroStrategy), delivered a bold and strategic response to growing skepticism about the company’s heavily leveraged Bitcoin approach. Amidst concerns over $MSTR’s declining stock value, Saylor unveiled a multi-billion dollar plan that could significantly influence institutional adoption and potentially alter Bitcoin’s price trajectory.

Read More: $1.34B Bitcoin Acquisition Sparks Market Shockwaves as Strategy Approaches $40B in BTC Holdings-Is a Market Correction on the Horizon?

Strategic Resilience: Buybacks, Bitcoin Accumulation, and Market Squeezes

Saylor did not shy away from probing questions, especially regarding what might happen if $MSTR’s net asset value (NAV) dips below parity-a scenario that has historically unsettled crypto markets during downturns. His response? Employ traditional financial tools such as STRK and STRF to repurchase shares, trigger short squeezes, and increase Bitcoin holdings.

“If our stock price fell to $1 tomorrow, we would simply recapitalize by issuing preferred shares and buying back common stock,” Saylor explained.

Unlike Grayscale’s GBTC, which is a closed-end trust with limited flexibility, Strategy operates as an agile enterprise with full access to debt markets, at-the-market (ATM) offerings, and recapitalization options. This financial agility not only enhances resilience but also makes the company a formidable opponent for short sellers betting against it.

Social media has already picked up on this strategic posture. A viral clip shared by a crypto commentator titled “Saylor is now aware of how far $MSTR has fallen… He might be holding onto the stock to squeeze shorts and buy Bitcoin again. Clever move.”

If this strategy unfolds, it could lead to a short-term market squeeze that elevates $MSTR’s stock price while simultaneously increasing Bitcoin accumulation-creating a feedback loop with long-term implications.

Bitcoin as the New Foundation of Global Capital

In a compelling keynote, Saylor declared that Bitcoin represents the ultimate form of incorruptible capital, signaling a profound shift in the global financial landscape.

“In the era of artificial intelligence, Bitcoin is becoming the core of capital,” he stated. “Traditional assets like bonds, real estate, and fiat currencies are increasingly vulnerable to obsolescence-they are likely to be replaced.”

Saylor envisions Bitcoin not just as an asset but as a foundational layer of trust for the 21st-century economy. As AI transforms labor and capital markets, digital stores of value such as Bitcoin are poised to become the most credible long-term hedge against inflation, monetary debasement, and economic instability.

He likened this transition to a civilizational evolution, suggesting that Bitcoin will serve as the bedrock of a new monetary order.

Read More: Trump’s $2.5B Bitcoin Purchase Sparks Market Excitement: BTC Emerges as the New Market Leader Amid Saylor’s Call to Secure Your Crypto

The $1 Million Bitcoin Vision – The Role of Institutional Investment

Why a 10% Institutional Stake Could Trigger the Price Surge

One of the most striking moments of Saylor’s speech was his outline of a clear numerical pathway to a $1 million Bitcoin:

“We currently hold 580,250 BTC-roughly 2.5% of the total supply. If Wall Street allocates just 10% of its assets to Bitcoin, that’s when we could see the price reach $1 million per coin.”

Based on publicly available data, Strategy’s current valuation for its Bitcoin holdings is approximately $69,979, with total investments exceeding $40.6 billion. While Bitcoin’s price hovers near $70,000 today, a significant increase in institutional buying could dramatically tighten supply and push prices higher.

Saylor’s core argument is straightforward:

- There will never be more than 21 million BTC in existence.

- Approximately 19.7 million BTC have already been mined.

- Even a small fraction of institutional holdings could create a supply crunch, driving prices upward.

In this context, Strategy’s early accumulation positions it for a “once-in-a-century” advantage-comparable to owning oil reserves before the discovery of the oil industry.

Why Strategy’s Approach Outperforms Traditional Vehicles

Saylor emphasized that Strategy’s operational flexibility sets it apart from legacy investment vehicles like GBTC, which lack the ability to adapt swiftly to market changes.

“GBTC is a closed-end trust with no operational flexibility,” he pointed out. “We can issue new shares through ATMs, raise debt, and adjust our holdings rapidly.”

This active financial engineering allows Strategy to hedge against downturns, attract new capital, and pursue aggressive accumulation even during market dips. The company has already employed tools such as convertible debt, traditional equity, and ATM offerings across multiple jurisdictions to expand its Bitcoin position-often buying during price corrections.

This hybrid approach makes Strategy a unique entity in the crypto space: not merely a tech stock or a Bitcoin ETF, but a resilient balance sheet that responds to macroeconomic trends while actively participating in Bitcoin’s long-term growth.

Implications for the Broader Cryptocurrency Market

Saylor’s reaffirmation of his Bitcoin strategy signals to institutional investors that holding BTC via public companies like $MSTR is more than speculative-it’s a strategic asset acquisition model.

If Strategy executes a buyback to squeeze shorts, institutional players could:

- Use $MSTR as a proxy for Bitcoin exposure

- Drive Bitcoin’s market price higher through renewed accumulation

- Stimulate demand for regulated investment products like ETFs or direct purchases

With major firms like BlackRock and Fidelity already active in the space, and Bitcoin ETFs holding over 1 million BTC combined, Saylor’s thesis that a 10% institutional allocation could propel Bitcoin to new heights is increasingly plausible.