The Future of the US Dollar: Risks of Losing Reserve Currency Status Without Structural Reforms

Rising Concerns Over the US Dollar’s Dominance

The US dollar has long held the position of the world’s primary reserve currency, underpinning global trade and financial stability. However, recent economic developments and geopolitical shifts have sparked widespread debate about its sustainability. Financial leaders warn that without significant reforms, the dollar’s supremacy could be jeopardized, potentially leading to a major reshuffle in international monetary systems.

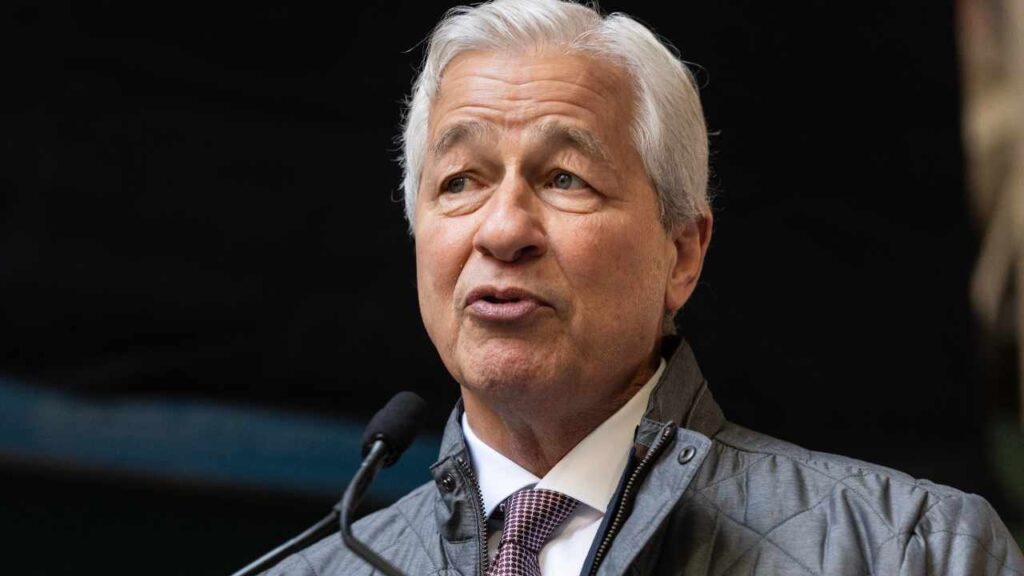

Expert Warnings: Internal Instability as a Threat

Jamie Dimon, CEO of JPMorgan Chase, has issued a stark warning about the potential decline of the US dollar’s global reserve status. He emphasizes that internal political chaos, economic mismanagement, and mounting debt levels threaten to undermine confidence in the dollar. If these issues persist, the US risks losing its economic influence, which could have far-reaching consequences for global markets.

The Implications of a Diminishing Dollar

The US dollar currently accounts for approximately 59% of all foreign exchange reserves worldwide, according to the International Monetary Fund (IMF). This dominance facilitates American economic policies and provides the US with considerable leverage in international finance. A decline in the dollar’s reserve status could lead to increased borrowing costs for the US, depreciation of the currency, and a shift toward alternative assets like cryptocurrencies, gold, or emerging market currencies.

Historical Context and Current Trends

Historically, reserve currencies have shifted over centuries-from the British pound to the US dollar. Today, countries like China are actively promoting the yuan as a potential alternative, especially as their economic influence grows. The recent surge in digital currencies and decentralized finance (DeFi) platforms further complicates the landscape, offering new avenues for international transactions outside traditional fiat systems.

The Need for Structural Reforms

To maintain its reserve currency status, the United States must address several critical issues. These include stabilizing political institutions, managing national debt responsibly, and enhancing financial transparency. Without these reforms, the dollar could face a gradual erosion of trust, prompting nations to diversify their reserves and seek more stable or promising alternatives.

The Broader Economic Impact

A shift away from the dollar could trigger volatility in global markets, affecting everything from commodity prices to international trade agreements. Countries heavily reliant on dollar-denominated debt might face increased financial stress, while emerging economies could benefit from diversification strategies. This transition period could reshape the global economic order, emphasizing the importance of proactive policy adjustments.

Looking Ahead: The Path to Stability

Experts advocate for comprehensive reforms to safeguard the dollar’s position. These include modernizing financial regulations, reducing political polarization, and fostering international cooperation. Such measures could reinforce confidence in the US economy and prevent a potential decline in the dollar’s reserve currency status.

Final Thoughts

The future of the US dollar hinges on the nation’s ability to implement meaningful reforms and address internal vulnerabilities. As global economic power dynamics evolve, the dollar’s dominance is not guaranteed. Stakeholders worldwide must stay vigilant and adaptable, recognizing that the stability of the international monetary system depends on prudent policy choices today.