The Modern American Dream: Owning a Full Bitcoin

Bitcoin’s Resilience Amid Geopolitical Tensions

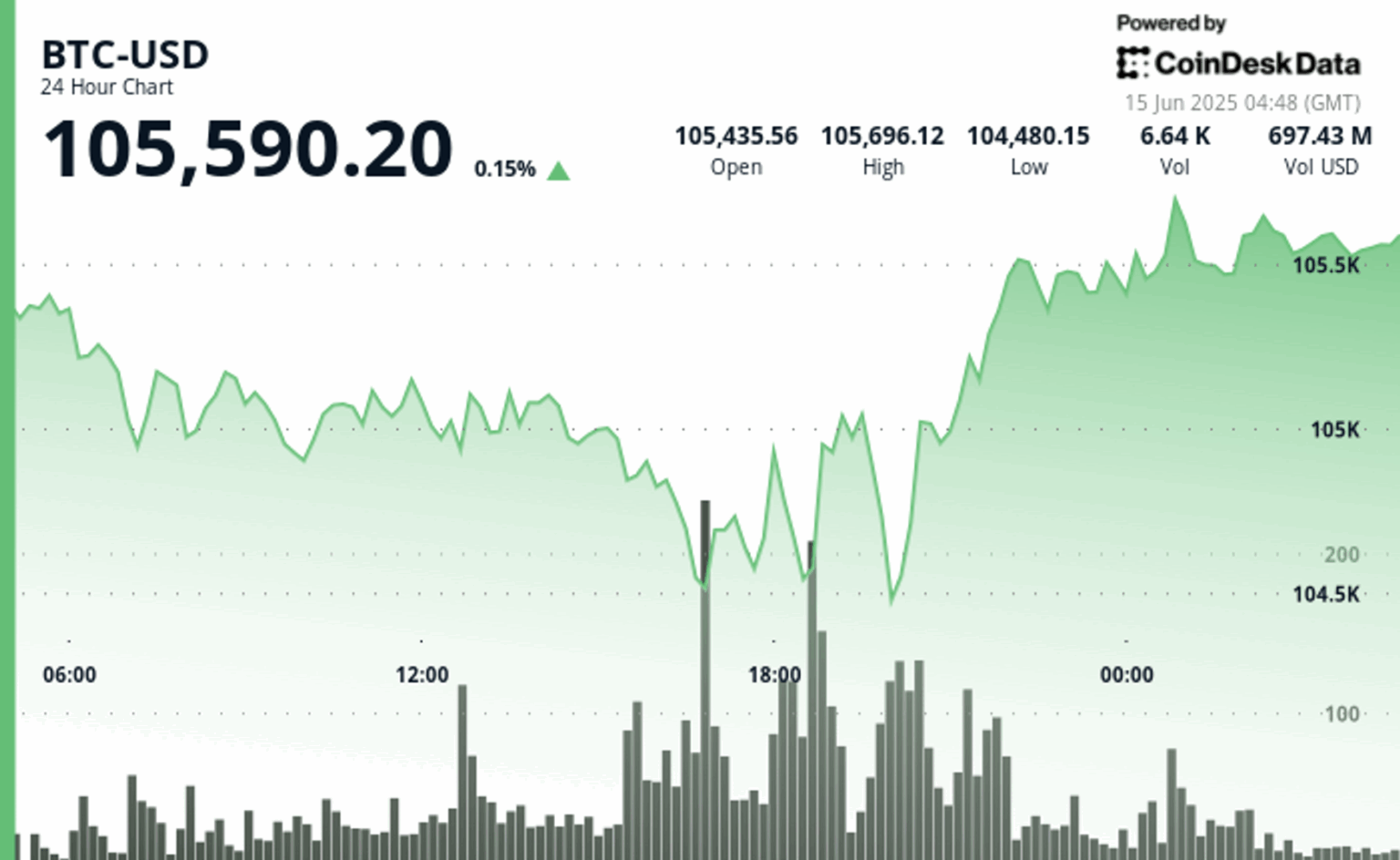

In recent trading sessions, Bitcoin (BTC) has demonstrated remarkable resilience, maintaining levels above $105,000 despite turbulent geopolitical developments in the Middle East. The cryptocurrency experienced a brief dip below $104,000 following Israel’s military strike on Iran, yet it swiftly recovered, currently trading at approximately $105,590-an increase of about 0.15% over the past day. This rapid rebound underscores Bitcoin’s underlying strength, with significant buying activity observed during the dip, signaling robust investor confidence.

Market analysts highlight the $104,000-$105,000 zone as a critical support level, with recent price action suggesting a steady upward trajectory. While short-term sentiment remains cautious-evidenced by a slight decline in trader optimism-the overall technical trend remains bullish, indicating that Bitcoin’s long-term momentum persists despite immediate volatility.

A New Generation’s Perspective on Wealth and Security

Beyond the immediate price movements, Bitcoin continues to captivate a younger demographic, reshaping traditional notions of wealth accumulation. In a recent discussion on the Unchained podcast, Jeff Park, Head of Alpha Strategies at Bitwise Asset Management, emphasized how Bitcoin’s appeal extends beyond conventional financial ambitions.

Unlike previous generations that prioritized homeownership and the white-picket-fence lifestyle, many young investors now aspire to become “wholecoiners”-individuals who own at least one full Bitcoin-as a symbol of financial independence and social status. For some, this goal transcends personal wealth, aiming instead to establish a lasting financial legacy that can be passed down through generations, echoing the popular meme of “retiring your bloodline.”

Park further explained that Bitcoin’s decentralized and apolitical nature plays a pivotal role in this shift. It offers a universal value system that allows individuals worldwide to “opt out” of traditional, often untrustworthy, financial systems. This cultural transformation positions Bitcoin not merely as a speculative asset or hedge but as a social marker of sovereignty and self-reliance.

Market Technicals and Future Outlook

Recent technical analysis reveals Bitcoin’s current trading range between approximately $104,480 and $105,700, with a close near $105,590. The support zone around $104,400-$104,500 has been reinforced through high-volume accumulation, particularly during the late afternoon hours GMT. An intraday breakout at 02:01 UTC saw Bitcoin surge from $105,486 to $105,550 amid increased trading activity, suggesting strong buying interest.

The consolidation above $105,470 hints at potential upward movement toward $106,000, provided demand remains steady. As macroeconomic factors and geopolitical tensions continue to influence markets, Bitcoin’s ability to sustain above key levels will be crucial in determining its near-term trajectory.

The Broader Significance of Bitcoin Ownership

Owning a full Bitcoin has become a modern symbol of financial sovereignty, especially among younger investors who view it as a safeguard against systemic instability. Recent surveys indicate that the number of “wholecoiners” has grown significantly, with estimates suggesting that over 10 million individuals worldwide now hold at least one full Bitcoin-a figure expected to rise as awareness and adoption increase.

This shift reflects a broader cultural movement where digital assets serve as a form of resistance against traditional financial institutions, offering a decentralized alternative rooted in transparency and global accessibility. As Bitcoin’s narrative evolves, it increasingly embodies the ideals of independence, security, and legacy-building for a new generation of investors.

Conclusion: A Long-Term Perspective Amid Short-Term Fluctuations

While short-term market fluctuations and geopolitical uncertainties may cause temporary dips, the overarching trend for Bitcoin remains upward. Its ability to recover swiftly from shocks, combined with growing institutional interest and expanding retail adoption, suggests that owning a full Bitcoin is increasingly viewed as a modern emblem of financial freedom-akin to the American Dream of the 21st century.

Technical Summary

- Bitcoin traded within a range of approximately $104,480 to $105,700, closing near $105,590.

- Support levels are solidified around $104,400-$104,500, with high-volume activity confirming interest.

- A bullish reversal was observed at 21:00 GMT, pushing prices above $105,000 on strong volume.

- An intraday breakout at 02:01 UTC saw a quick jump from $105,486 to $105,550.

- Continued consolidation suggests potential for further gains toward $106,000, contingent on sustained demand.