Bitcoin Mining Sector Accelerates Amid Near-Zetahash Network Milestone

Rising Challenges for Public Bitcoin Miners as Hashrate Approaches New Heights

As the Bitcoin network approaches a historic hashrate milestone nearing one zettahash per second (ZH/s), mining operations worldwide are under increasing pressure to scale efficiently. According to the latest monthly insights from TheMinerMag, the network’s computational power continues its upward trajectory, with the current 14-day average hashrate reaching approximately 913.54 exahashes per second (EH/s). This surge has driven the network’s mining difficulty to an all-time high of 126.98 trillion, reflecting intensified competition among miners.

Economic Strain and Cost Dynamics in Bitcoin Mining

Despite Bitcoin’s relatively stable price, the economic landscape for miners is becoming more challenging. Transaction fees in June dipped below 1% of block rewards, and the hashprice-a metric indicating the value per unit of mining power-experienced a slight rebound after falling to around $52 per PH/s. These indicators suggest a tightening profit margin environment, especially as operational costs escalate.

Forecasts indicate that the average cost to produce a single Bitcoin could surpass $70,000, up from approximately $64,000 earlier this year. This increase is primarily driven by rising energy expenses and heightened competition, compelling miners to seek more efficient hardware and operational strategies to stay afloat.

Strategic Expansion and Technological Upgrades

In response to these mounting pressures, publicly traded mining firms are rapidly expanding their infrastructure. Notable players such as MARA Holdings, CleanSpark, Riot Platforms, and IREN are aggressively scaling their operations. For instance, MARA increased its hashrate by 30% in May, while HIVE Blockchain added 32% after activating a new facility in Paraguay. Cipher Mining aims for a 70% growth by expanding its Texas-based operations, reflecting a broader industry trend toward capacity augmentation.

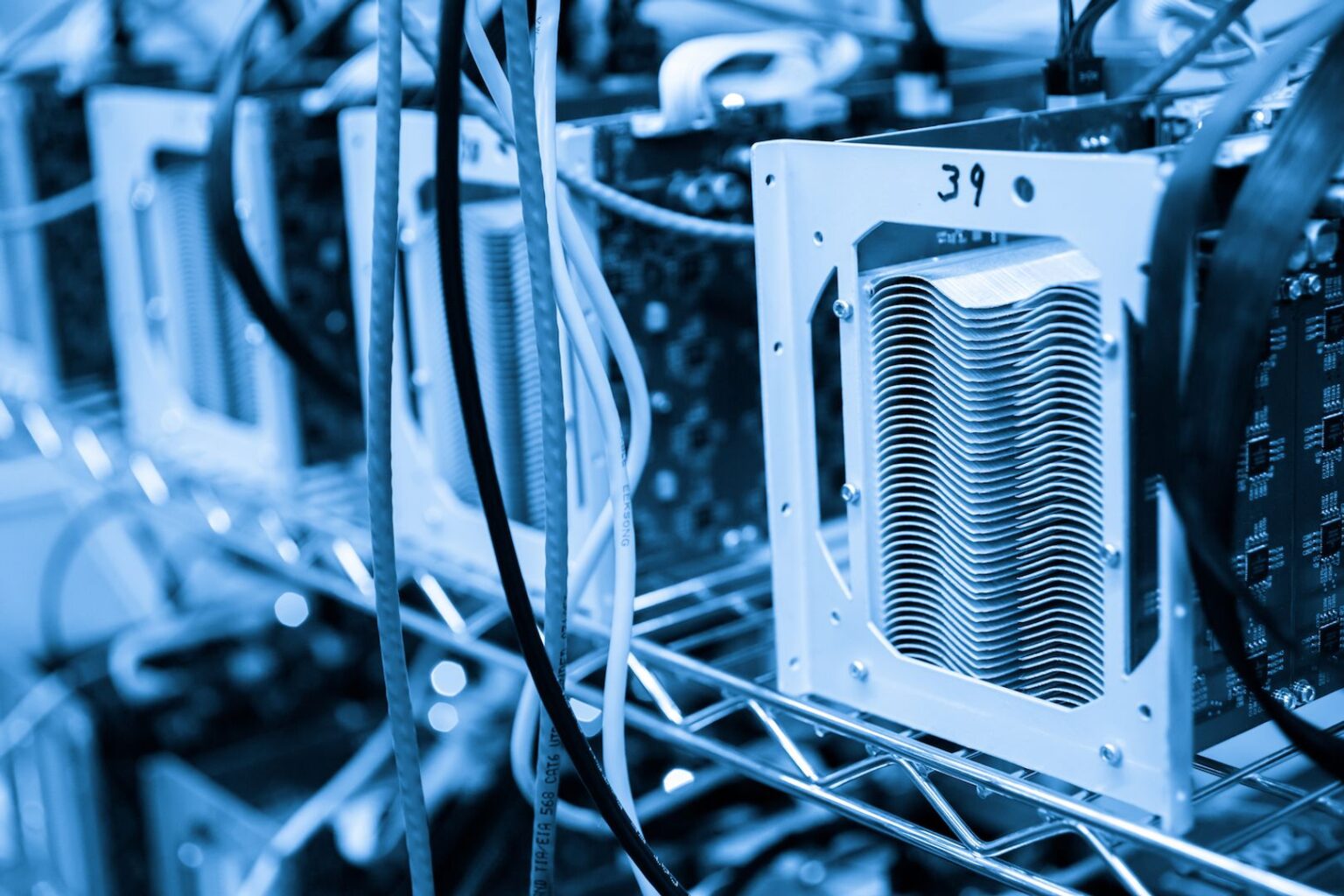

The adoption of advanced ASIC (Application-Specific Integrated Circuit) miners remains a key focus. Currently, high-performance ASICs are priced between $10 and $30 per terahash, with payback periods extending up to two years-assuming electricity costs of around $0.06 per kWh. However, for some miners, higher energy rates, such as the $0.081 per kWh paid by Terawulf in Q1, significantly increase operational costs, pushing hash costs upward by over 25%.

Market Performance Diverges from Bitcoin’s Price Trends

Interestingly, the stock performance of mining companies is increasingly decoupling from Bitcoin’s price movements. Over the past month, firms like IREN, Core Scientific, and Bit Digital have experienced gains, whereas others such as Canaan and Bitfarms have seen double-digit declines. This divergence indicates that investors are now placing greater emphasis on individual business models, operational efficiencies, and strategic growth plans rather than solely tracking Bitcoin’s market value.

Looking Ahead: The Future of Bitcoin Mining

As the network approaches the one ZH/s threshold, the mining industry is at a pivotal juncture. The push for technological innovation, cost management, and capacity expansion will be critical for miners aiming to remain competitive. Meanwhile, the broader market’s focus on operational resilience suggests a maturing industry that values sustainable growth over mere hash rate escalation.

Additional Insights and Industry Trends

Recent data underscores the importance of energy efficiency and strategic location selection. For example, miners are increasingly establishing operations in regions with abundant renewable energy sources, such as Paraguay and Texas, to mitigate costs and environmental impact. Furthermore, the industry is witnessing a shift toward more sophisticated financial instruments and hedging strategies to navigate volatile electricity markets and fluctuating Bitcoin prices.

Conclusion

The race to scale in Bitcoin mining is intensifying as the network approaches unprecedented hashrate levels. While technological advancements and infrastructure investments are vital, managing operational costs and adapting to market dynamics will determine the long-term sustainability of mining enterprises. As the industry evolves, stakeholders must balance growth ambitions with economic prudence to thrive in this highly competitive landscape.

Disclaimer: Portions of this article were generated with AI assistance and reviewed by our editorial team to ensure accuracy and compliance with our standards. For more details, please refer to CoinDesk’s AI Policy.