Bitcoin and Dogecoin: Navigating Market Resilience Amid Global Turmoil

Market Overview: Dogecoin’s Recent Surge and Stability

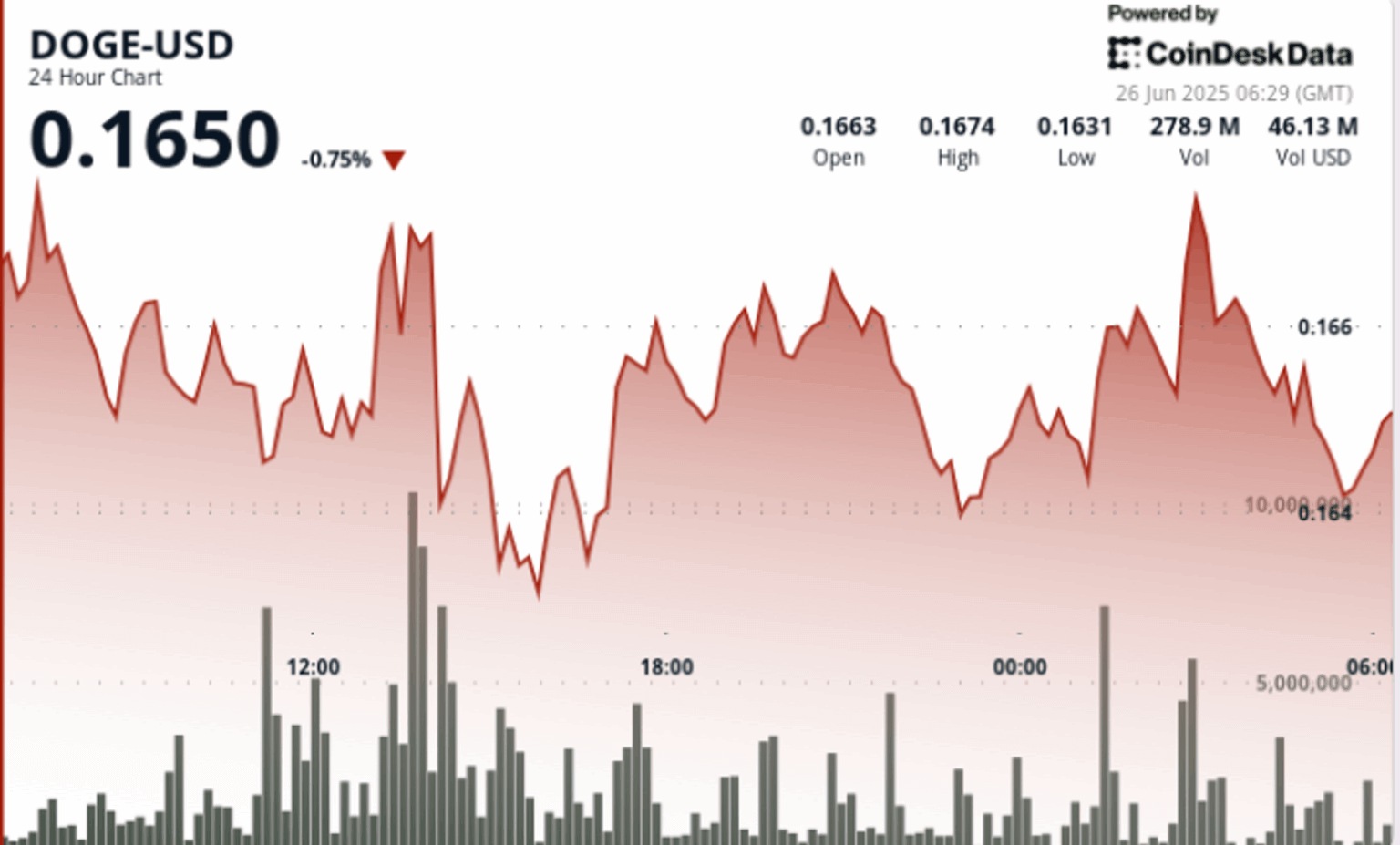

As of late June 2025, Dogecoin (DOGE) has demonstrated notable resilience, rebounding sharply from weekend lows and maintaining a crucial support level at approximately $0.16. Despite ongoing geopolitical conflicts and macroeconomic uncertainties, DOGE has managed to stabilize above $0.165, closing the session at $0.1657-a nearly 3% increase from its lowest point during the trading period. This upward momentum signals a potential shift in market sentiment, especially as investors seek refuge in assets with strong community backing and strategic developments.

Key Factors Influencing DOGE’s Performance

- Market Recovery Post-Weekend Dip: DOGE experienced a 17% rebound from its weekend lows, driven by renewed buying interest that defended the critical $0.16 support zone. This bounce-back underscores the coin’s capacity to withstand broader market pressures.

- Global Tensions and Economic Uncertainty: The broader cryptocurrency landscape remains volatile, with escalating geopolitical tensions and economic instability impacting investor confidence. Nonetheless, DOGE’s ability to hold its ground suggests a growing confidence among retail traders and institutional players alike.

- Strategic Developments and Influences: Coinbase’s recent support for decentralized finance (DeFi) applications utilizing wrapped Dogecoin (wDOGE) on its Layer-2 Base network has expanded the token’s utility. Additionally, Elon Musk’s ongoing influence-particularly through his social media platform X, which has secured money transmitter licenses in 39 U.S. states-continues to sway market sentiment, even amid unconfirmed rumors of direct DOGE integration.

Recent Price Movements and Technical Insights

Over the past 24 hours, DOGE traded within a narrow range of $0.1628 to $0.1677, reflecting a 2.97% swing. The support level at $0.1628 proved robust, with nearly 300 million DOGE exchanged during a key buying surge at 15:00 UTC. Resistance was encountered at $0.1677, where a high-volume rejection capped further gains.

In the final trading hour, DOGE gained approximately 1%, climbing from $0.1645 to $0.1661. Notable volume spikes at 01:28 and 01:34 UTC-reaching 10.7 million and 20.1 million DOGE respectively-confirmed strong buyer interest, pushing the price to a local peak of $0.1664. The session concluded with the asset consolidating above $0.1659, indicating a potential bullish continuation.

Technical Summary

- Price Range: $0.1628-$0.1677, with a 2.97% increase

- Support Level: $0.1628, supported by high trading volume

- Resistance Level: $0.1677, marked by rejection during high-volume trading

- Closing Price: $0.1657, forming a higher low pattern indicative of bullish momentum

- Volume Spikes: Confirmed buyer interest, especially during late-session surges

Broader Cryptocurrency Market Context

The crypto sector has faced turbulence due to geopolitical conflicts, trade disruptions, and macroeconomic shifts. Despite these headwinds, Dogecoin has maintained its footing after a sharp decline to around $0.142 earlier this month. The token’s ability to recover and stabilize highlights its unique position within the market, driven by community support, strategic platform integrations, and influential endorsements.

Coinbase’s recent addition of support for DeFi applications utilizing wrapped DOGE on its Layer-2 network signifies a move toward increasing the token’s practical applications. Meanwhile, Elon Musk’s social media influence continues to generate speculative buzz, with the platform’s licensing expansion adding to the narrative of DOGE’s potential mainstream adoption.

Market Dynamics and Future Outlook

In the last 24 hours, DOGE traded between $0.1628 and $0.1677, with notable support at $0.1628 during a surge in buying activity. The asset’s ability to hold above this level, coupled with volume confirmation, suggests a bullish trend may be emerging. The technical pattern of higher lows and resistance at $0.1677 indicates potential for further upside, especially if broader market conditions stabilize.

Investors should monitor key support and resistance levels, as well as volume trends, to gauge future movements. The influence of social media personalities and platform integrations will likely continue to play a significant role in shaping DOGE’s trajectory.

Expert Insights and Market Analysis

Shaurya Malwa, Co-Leader of CoinDesk’s tokens and data team in Asia, emphasizes that Dogecoin’s recent performance reflects a broader pattern of resilience among meme coins and community-driven tokens. Despite macroeconomic headwinds, strategic developments like DeFi support and influential endorsements can catalyze upward momentum.

CoinDesk Analytics, leveraging AI-powered tools and human oversight, continues to monitor these trends, providing timely insights into market movements. Their analysis underscores the importance of volume confirmation, support levels, and macro factors in predicting future price actions.

Final Thoughts

Dogecoin’s recent rebound amid global uncertainties underscores its unique position as a community-backed asset with growing utility. While macroeconomic and geopolitical risks persist, strategic platform support and influential endorsements could propel DOGE toward new highs. Investors should remain vigilant, focusing on technical signals and market sentiment to navigate the evolving landscape of cryptocurrency trading.

Stay updated with the latest market insights and analysis on CoinDesk, your trusted source for cryptocurrency news.