Revolutionizing Messaging and Financial Integration on X: A New Era

In a bold move towards transforming its messaging platform, X is rolling out a revamped version of its direct messaging (DM) system, with select users gaining early access to the beta version of the platform’s innovative “Chat” feature. This development signals a strategic shift aimed at enhancing user privacy and expanding the app’s functional scope.

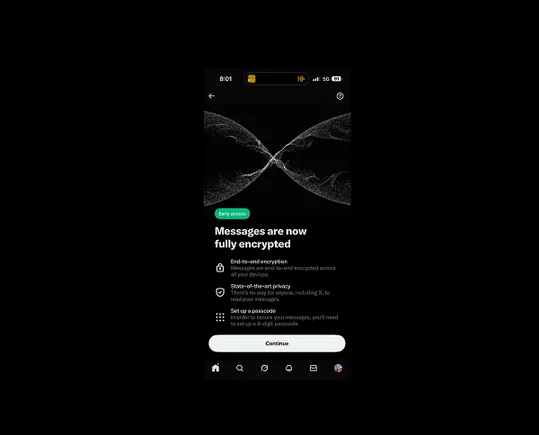

Enhanced Privacy and Security in Messaging

As demonstrated by recent examples shared by app researcher Jonah Manzano, X is overhauling its DM infrastructure to prioritize user confidentiality. Central to this upgrade is the integration of end-to-end encryption, ensuring that conversations remain private and secure from external access. To set up a new chat profile, users will need to verify their identity with a four-digit code, adding an extra layer of security to their interactions.

Introducing Financial Capabilities within Messaging

The upgraded direct messaging system is not just about privacy; it also aims to facilitate financial transactions. The new security features are expected to support X’s upcoming in-app payment services, providing users with greater confidence when sharing money. This move could potentially revolutionize how users transfer funds, making the process seamless and integrated within their social interactions.

Looking ahead, X appears to be exploring broader financial functionalities, such as allowing users to load cash into their profiles or stories, effectively creating a hybrid space for social engagement and savings. While the specifics remain under wraps, Elon Musk has emphasized the importance of caution when handling user funds, underscoring the need for robust security measures.

Drawing Inspiration from Global Success Stories

Elon Musk envisions a platform reminiscent of WeChat, the Chinese super-app that combines messaging, social media, and financial services into a single ecosystem. Musk’s concept, dubbed the “all-in-one app,” aims to replicate this model in Western markets, integrating features like payments, banking, and social networking to create a comprehensive user experience.

This vision is rooted in Musk’s earlier ambitions for PayPal, which he helped develop before his departure in 2000. Since then, he has been contemplating a unified platform that merges communication and financial services, with the recent focus on enhancing DMs serving as a critical step in this evolution.

Challenges and Lessons from Global and Western Markets

Despite the promising concept, replicating WeChat’s success in Western countries has proven difficult. Platforms like Meta have attempted similar integrations-reimagining Messenger with features like Facebook Pay and Libra-yet these efforts have faced regulatory hurdles and limited user adoption. Meta’s Facebook Pay, for instance, remains a shadow of its initial potential, hindered by privacy concerns and regulatory resistance.

Other platforms, including TikTok, Twitter, Pinterest, Instagram, and YouTube, have experimented with in-app purchasing and payment features. While these initiatives show promise, widespread adoption remains elusive, largely because Western consumers tend to prefer established, trusted payment providers like Amazon or PayPal for financial transactions.

In theory, a unified social and financial platform should be a natural evolution, but practical challenges-regulatory restrictions, privacy issues, and user trust-have hindered progress. Despite Musk’s confidence, the road to creating a Western version of WeChat is fraught with obstacles.

Regulatory Hurdles and Market Realities

One significant barrier is the difficulty X faces in obtaining necessary licenses to operate as a payment processor in the United States. Last year, New York State rejected X’s application, citing concerns over its ownership structure, notably its ties to Saudi Arabia, where Crown Prince Mohammed bin Salman is an investor. This connection has raised alarms due to the country’s history of repression and human rights abuses, which critics argue are enabled by platforms like X.

Such regulatory challenges are not unique to X; they reflect broader skepticism about integrating social media with financial services in Western markets. As of mid-2023, X has yet to launch its payment features in multiple countries, and initial plans to have payments active by the end of last year have been delayed.

Elon Musk initially expressed optimism, suggesting that by late 2022, payments would be a core feature of X. However, as 2025 progresses, the integration remains incomplete, and the platform continues to grapple with regulatory approval and user trust issues.

The Future of X’s Financial and Messaging Ecosystem

While the potential for a fully integrated social and financial platform remains compelling, the journey is complex. The current landscape indicates that even with regulatory approvals and technological advancements, user adoption in Western markets may be limited unless trust and security are convincingly established.

Despite these hurdles, Elon Musk’s reputation for disruptive innovation suggests that he may have a few tricks up his sleeve. The upcoming launch of the new X Chat feature could serve as a catalyst, paving the way for broader financial functionalities in the future.

In conclusion, although X’s ambitions to create a comprehensive, all-in-one social and financial platform are ambitious, the path forward involves overcoming significant regulatory, technical, and cultural challenges. The next few months will be critical in determining whether Musk’s vision can materialize into a mainstream reality or remain an aspirational concept.