Looking ahead to 2025, investors should keep an eye on emerging low-market-cap cryptocurrencies poised for significant growth during the next bullish cycle. Notable contenders include Solaxy ($SOLX), SUBBD ($SUBBD), Mind of Pepe ($MIND), Simplest Wallet ($BEST), Bitcoin Hyper ($HYPER), Bitcoin Bull ($BTCBULL), Kyber Network Crystal ($KNC), Kamino ($KMNO), LooksRare, and Omni Community ($OMNI). These tokens typically have a market valuation around $100 million, reflecting their potential for rapid appreciation driven by innovative technology, dedicated teams, and increasing community interest.

To identify promising low-cap cryptocurrencies, it’s essential to analyze factors such as use case relevance, community engagement, liquidity levels, trading volume, team credibility, and overall market sentiment. This guide aims to highlight the most attractive low-market-cap cryptos for investment today. We will explore what defines a low-cap crypto, its advantages and risks, and provide a step-by-step process for purchasing these assets.

1. Solaxy ($SOLX): A Layer-2 Solution for Solana

Solaxy ($SOLX) stands out as a pioneering low-cap project, serving as the first Layer-2 scaling platform for the Solana blockchain. While Solana is renowned for its speed, network congestion during peak times can cause delays and transaction failures. Solaxy addresses this issue by processing transactions off the main chain, batching them, and then submitting them collectively for validation, significantly enhancing throughput and reducing fees. During its presale, $SOLX has already amassed over $41 million, with tokens priced at approximately $0.001738.

Use Cases and Strategic Advantages

Primarily, Solaxy aims to bolster the Solana ecosystem by enabling faster, more scalable transactions. Its batching technology is vital for supporting a wide range of decentralized applications (dApps). Additionally, plans to develop a bridge between Solana and Ethereum could facilitate seamless asset transfers across these major networks, unlocking new liquidity channels and interoperability benefits.

Growth Potential and Future Outlook

The long-term prospects for Solaxy are promising, especially as Solana’s ecosystem continues to expand rapidly. The project’s recent move to introduce staking rewards-currently offering an impressive 96% APY-may incentivize long-term holding. Upcoming listings on major exchanges are expected to increase visibility and attract further investment, potentially driving the token’s value higher.

2. SUBBD ($SUBBD): Empowering Content Creators with Web3

SUBBD is an emerging ERC-20 token designed to revolutionize the creator economy by integrating Web3 features and AI-driven content creation tools. Focused on addressing common issues faced by creators-such as high platform fees and lack of ownership-SUBBD offers a decentralized platform where creators can monetize their work through subscriptions, pay-per-view content, and NFT sales. Its presale has already attracted significant interest, raising over $547,000, with the token valued at around $0.0555.

Application Scope and Benefits

For content creators, SUBBD provides multiple revenue streams, including subscriptions, one-time payments, and NFT transactions, all with reduced fees. The platform’s AI tools assist in generating visual content and automating workflows, boosting productivity. Supporters holding $SUBBD tokens gain access to premium content, discounted subscriptions, and staking opportunities offering 20% APY. Early adopters can also participate in governance decisions, influencing platform development.

Market Growth and Strategic Outlook

The future growth of SUBBD hinges on the widespread adoption of the creator economy, which is projected to reach approximately $90 billion by 2033. As the creator industry expands, demand for efficient, low-cost monetization tools will increase. The project’s team allocates 30% of tokens to marketing efforts and 20% to product development, aiming to capture a significant share of this burgeoning market.

3. Mind of Pepe ($MIND): AI-Driven Meme Cryptocurrency

Mind of Pepe ($MIND) is a novel meme-focused cryptocurrency powered by artificial intelligence. Built on the Ethereum network, it features an AI agent that analyzes social media trends and blockchain data to predict market movements and generate insights. The AI also interacts with social platforms like X (formerly Twitter), posting updates and even creating its own tokens. The presale has already raised over $11 million, with tokens priced at roughly $0.00375.

Use Cases and Utility

The core utility of $MIND lies in its AI’s ability to deliver real-time market insights, facilitate social media engagement, and create new tokens for community-driven projects. Holders gain early access to these features, positioning $MIND as a potential tool for traders and meme enthusiasts alike.

Growth Outlook and Market Potential

The AI meme coin sector is gaining momentum, especially as AI adoption accelerates within the crypto space. The successful presale and high staking APY-up to 214%-indicate strong community backing and growth potential. As AI and meme tokens continue to evolve, $MIND could become a significant player in this niche, offering both entertainment and utility for investors.

4. Simplest Wallet ($BEST): User-Friendly Multi-Chain Wallet

Simplest Wallet ($BEST) is a low-cap project centered around a non-custodial multi-chain wallet that supports numerous blockchains, including Ethereum, Bitcoin, and Solana. Unlike many conceptual projects, Simplest Wallet has a functional app available on Google Play and the App Store, with over 500,000 users and more than $12.7 million raised during its presale. The wallet offers benefits such as reduced transaction fees and early access to new token sales.

Use Cases and Advantages

Holding $BEST within the wallet grants users fee discounts, governance rights, and priority access to upcoming token launches. Its multi-chain support and focus on security-using MPC technology and Fireblocks-backed insurance-aim to attract a broad user base seeking a secure, versatile crypto management solution.

Market Potential and Strategy

Targeting a significant share of the crypto wallet market, Simplest Wallet aims for a 40% market penetration through its multi-chain approach. Its user-friendly interface and emphasis on security are designed to appeal to both newcomers and experienced traders, positioning it for substantial growth.

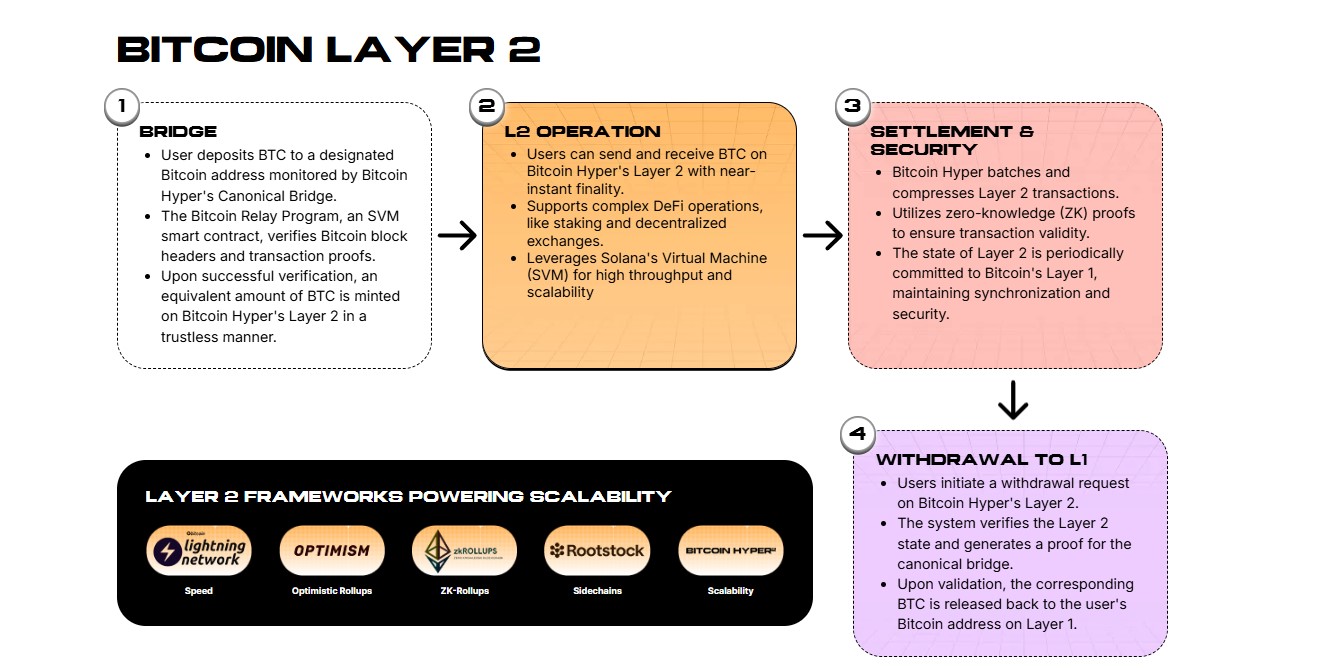

5. Bitcoin Hyper ($HYPER): Enhancing Bitcoin Transactions

Bitcoin Hyper ($HYPER) is a Layer-2 platform designed specifically for Bitcoin, aiming to facilitate faster and cheaper transactions. By leveraging second-layer technology, users can send and receive BTC with near-instant finality, making everyday transactions like coffee purchases or small peer-to-peer transfers feasible without high fees. Currently in presale, tokens are available at approximately $0.0117.

Use Cases and Benefits

Bitcoin Hyper’s primary goal is to improve Bitcoin’s scalability, enabling it to serve as a practical medium of exchange for daily use. Its platform supports DeFi activities such as staking and decentralized exchanges, broadening Bitcoin’s utility beyond simple store-of-value functions.

Future Outlook

If Bitcoin Hyper successfully addresses Bitcoin’s scalability challenges, it could significantly increase Bitcoin’s adoption for everyday transactions and DeFi applications. This would attract both users and developers seeking a faster, more cost-effective Bitcoin experience.

6. Bitcoin Bull ($BTCBULL): Rewards Linked to Bitcoin Milestones

Bitcoin Bull ($BTCBULL) is a low-market-cap token that combines community engagement with reward mechanisms. After raising over $6 million during its presale, the token on Ethereum has a circulating supply of 21 billion, mirroring Bitcoin’s maximum supply of 21 million but scaled up for accessibility. The project aims to reward holders with Bitcoin-based airdrops when certain price milestones are achieved, such as $150,000 or $200,000 per BTC.

Use Cases and Incentives

Holders of $BTCBULL can expect to receive Bitcoin rewards as the price hits predefined targets. Additionally, the token employs a deflationary model where a portion of tokens is burned at key milestones, reducing supply and potentially increasing value. If Bitcoin reaches $225,000 by 2025, rewards and token burns could accelerate, boosting the token’s appeal.

Growth Outlook

The success of $BTCBULL largely depends on Bitcoin’s price trajectory. If Bitcoin’s value surges as predicted, the token could see increased rewards and scarcity, making it an attractive speculative asset.

7. Kyber Network Crystal ($KNC): Decentralized Liquidity Infrastructure

Kyber Network Crystal (KNC) is the native token of the Kyber Network, a decentralized liquidity protocol that enables seamless token swaps across multiple blockchains. Its core mission is to facilitate efficient DeFi transactions and decentralized exchanges by providing access to diverse liquidity pools at optimal rates.

Use Cases and Governance

KNC functions as both a utility and governance token. Holders can participate in voting via KyberDAO to influence fee structures, protocol upgrades, and other key decisions. The token also plays a role in staking and fee burning, which helps reduce circulating supply over time.

Market Outlook and Expansion

As DeFi continues to grow, protocols like Kyber that offer robust liquidity solutions are expected to see increased demand. Its multi-chain approach, supporting Ethereum, Polygon, and BNB Chain, broadens its reach and user base, making KNC a promising low-cap investment with potential for appreciation.

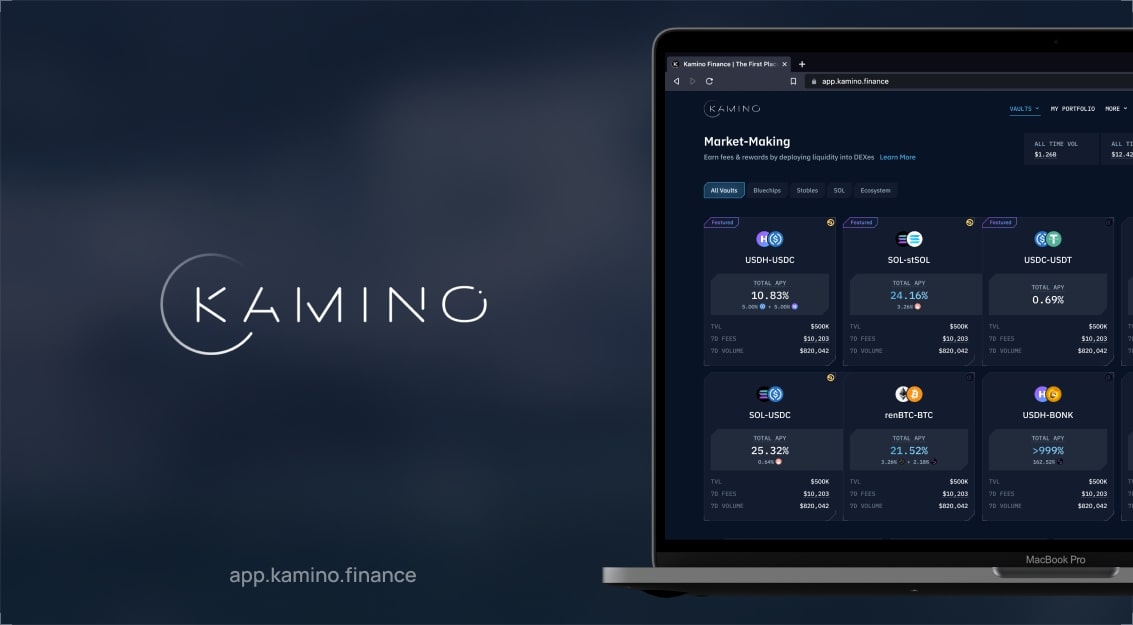

8. Kamino ($KMNO): A DeFi Platform on Solana

Kamino ($KMNO) is a decentralized finance (DeFi) project built on Solana, integrating lending, liquidity pools, and leverage into a unified platform. With a current market cap of approximately $102 million, Kamino offers features such as liquidity vaults, interest-earning lending, and leveraged yield farming through “Multiply Vaults” and “Long/Short Vaults.”

Use Cases and Growth Potential

Kamino’s innovative liquidity vaults automate the process of providing liquidity on Solana’s decentralized exchanges. Users can lend, borrow, and leverage their assets to maximize yields. Its strategic position within Solana’s rapidly expanding DeFi ecosystem suggests strong growth prospects as the network gains adoption.

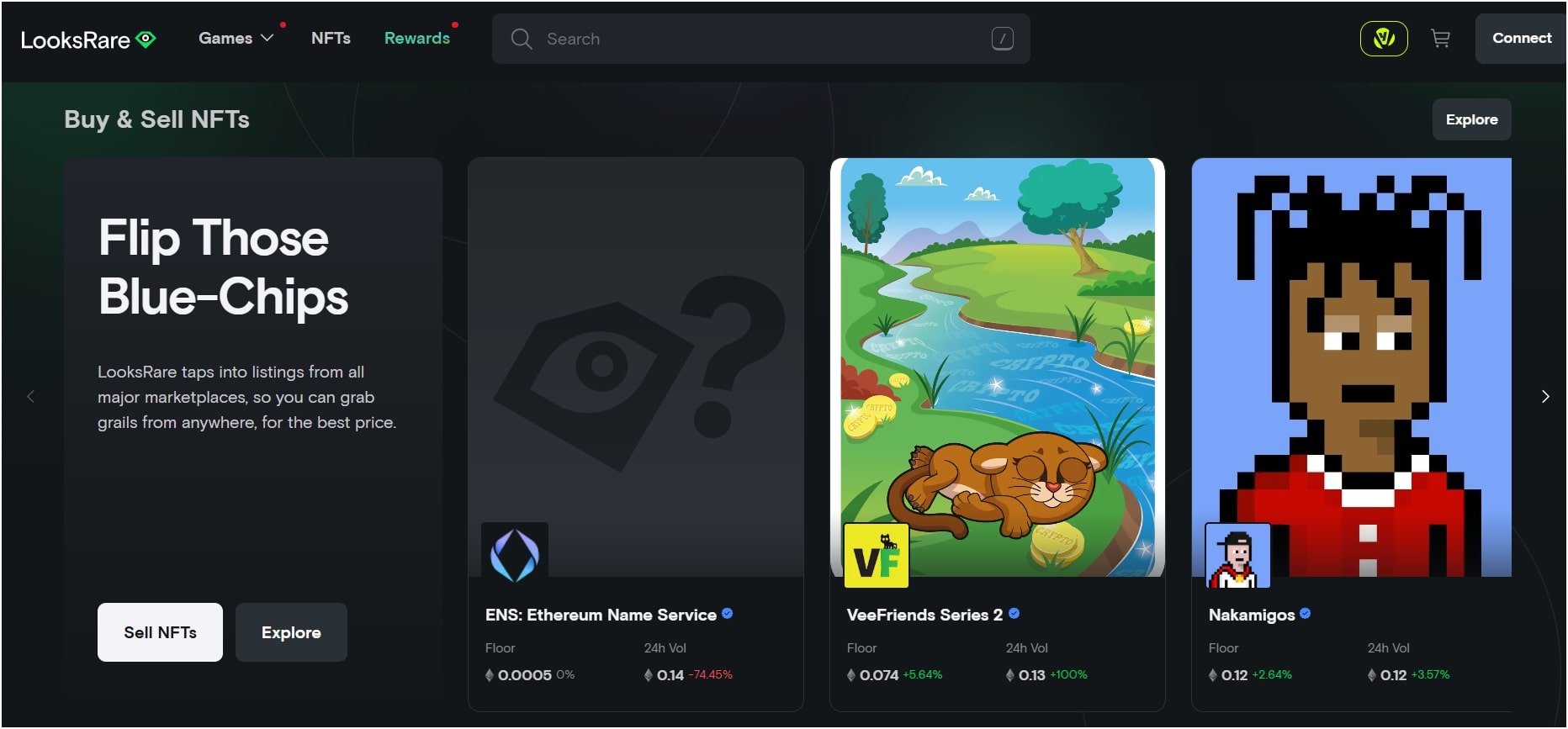

9. LooksRare ($LOOKS): NFT Marketplace with Incentives

LooksRare is a decentralized NFT marketplace launched in 2022, aiming to challenge the dominance of platforms like OpenSea. Its native token, $LOOKS, trades at around $0.0165 with a market cap near $16 million. The platform rewards users with $LOOKS tokens for buying, selling, and staking NFTs, fostering an active community of collectors and traders.

Platform Features and Market Outlook

Users can participate in auctions, place bids, and stake tokens to earn a share of trading fees. The platform’s success hinges on the overall health of the NFT market, which has experienced fluctuations but shows signs of recovery. As NFT trading volume increases, LooksRare’s token could see a corresponding rise in value, especially if user activity and liquidity improve.

10. Omni Network ($OMNI): Cross-Chain Infrastructure for Ethereum

Omni Network ($OMNI) is a Layer-1 blockchain built on Ethereum, designed to address fragmentation within the ecosystem by enabling interoperability across various rollup solutions. Its goal is to create a cohesive environment where applications and assets can move seamlessly across different scaling layers, enhancing user experience and developer flexibility.

Use Cases and Future Potential

Omni acts as a bridge, allowing decentralized applications to operate across multiple rollups without losing liquidity or user base. Its native token, $OMNI, is used to pay transaction fees and participate in governance. As Ethereum’s ecosystem continues to evolve, Omni’s role in reducing fragmentation could position it as a critical infrastructure component, with substantial growth potential.

What Are the Leading Low-Cap Cryptos for 2025?

In 2025, the most promising low-market-cap cryptocurrencies include Solaxy ($SOLX), SUBBD ($SUBBD), Mind of Pepe ($MIND), Simplest Wallet ($BEST), Bitcoin Hyper ($HYPER), Bitcoin Bull ($BTCBULL), Kyber Network Crystal ($KNC), Kamino ($KMNO), LooksRare, and Omni Network ($OMNI).

Understanding Low Market Cap in Cryptocurrency

Low market cap cryptocurrencies are those with a relatively small total valuation, typically below $100 million, though sometimes up to $300 million. Market cap is calculated by multiplying the current price by the circulating supply. These assets are often newer or less established, with lower trading volumes and liquidity, but they also offer higher growth potential due to their early-stage nature.

Benefits of Investing in Low-Cap Digital Assets

- High Growth Potential: Small market caps mean that even modest increases in adoption or recognition can lead to exponential price gains, sometimes reaching 10x, 100x, or even 1000x returns.

- Early Access to Innovation: Investing early in emerging projects allows participation in groundbreaking technologies and platforms that could reshape the blockchain landscape.

- Portfolio Diversification: Including low-cap cryptos can hedge against volatility in larger assets, as these tokens often move independently and can benefit from community-driven momentum.

- Community and Influence: Many low-market-cap projects are community-centric, giving early investors opportunities to shape development and participate actively in governance.

Risks Associated with Low-Cap Investments

- Extreme Volatility: Prices can swing wildly due to low liquidity and limited trading activity, leading to rapid gains or steep losses.

- Liquidity Challenges: Limited buyers and sellers can make it difficult to execute large trades without impacting the price significantly.

- Higher Failure Rate: Many low-cap projects are unproven, with small teams and limited resources, increasing the risk of project failure or abandonment.

- Regulatory Risks: Smaller projects are more vulnerable to regulatory crackdowns, delistings, or bans, which can wipe out investments overnight.

How to Purchase Low-Cap Cryptocurrencies

Options include centralized exchanges, decentralized platforms, and direct presale participation. Here’s a step-by-step guide to acquiring tokens like Solaxy ($SOLX) during its presale:

Step 1: Secure a Reliable Crypto Wallet

Start by setting up a secure wallet compatible with the blockchain of your target token. For $SOLX, which is an ERC-20 token, a wallet supporting Ethereum is necessary. We recommend Simplest Wallet-free, user-friendly, and supporting multiple chains. Download from Google Play or the App Store, create an account, set a strong password, and enable two-factor authentication for security.

Step 2: Fund Your Wallet

Deposit funds into your wallet using popular exchanges like Coinbase, Binance, or Kraken. Purchase stablecoins such as USDT, ETH, or BNB with fiat currency, then transfer these to your wallet. Simplest Wallet also offers direct fiat-to-crypto purchases, simplifying the process.

Step 3: Participate in the Presale

Visit the official Solaxy presale site at solaxy.io, connect your wallet, and authorize the transaction. Enter the amount of ETH, USDT, or BNB you wish to invest, and the platform will calculate your token allocation. Once the presale concludes, your tokens will be available in your wallet.

Identifying Low-Cap Altcoins with 1000x Growth Potential

To spot low-cap altcoins with the potential for 1000x returns, consider factors such as real-world use case, community activity, liquidity, trading volume, team credibility, and market sentiment.

Assess Use Case and Utility

Look for tokens addressing genuine problems or offering innovative services. Projects with clear, practical applications and strong demand are more likely to succeed. For detailed insights, refer to our guide on the most undervalued cryptocurrencies to buy.

Evaluate Community Engagement

A vibrant, active community indicates strong interest and support. Platforms like Twitter, Telegram, and Discord reveal the level of enthusiasm and participation, which can drive organic growth and adoption.

Check Liquidity and Trading Volume

High liquidity and trading volume suggest ease of buying and selling without significant price slippage. Low volume assets can be highly volatile and difficult to exit, increasing risk. Aim for tokens with consistent activity and healthy order books.

Review Team and Roadmap

Research the project team’s background and experience. A credible team with a transparent, achievable roadmap indicates a higher likelihood of success. Look for milestones, development updates, and community transparency.

Monitor Market Trends and Sentiment

Stay updated on broader market developments, technological trends, and investor sentiment. Emerging sectors like AI, blockchain gaming, or DeFi innovations can influence low-cap coin performance. Use social media and news sources to gauge overall market mood.

Disclaimer

Please note that the information provided here is for educational purposes only and should not be considered financial advice. Investing in cryptocurrencies, especially low-cap altcoins, involves significant risk, including the potential loss of your entire investment. Conduct thorough research and consult with a licensed financial advisor before making any investment decisions. The author and platform are not responsible for any financial losses incurred.