LTC and ADA Market Dynamics: Navigating Whale Movements and Strategic Innovations

Cardano’s ADA Maintains Stability Amidst Large-Scale Liquidations

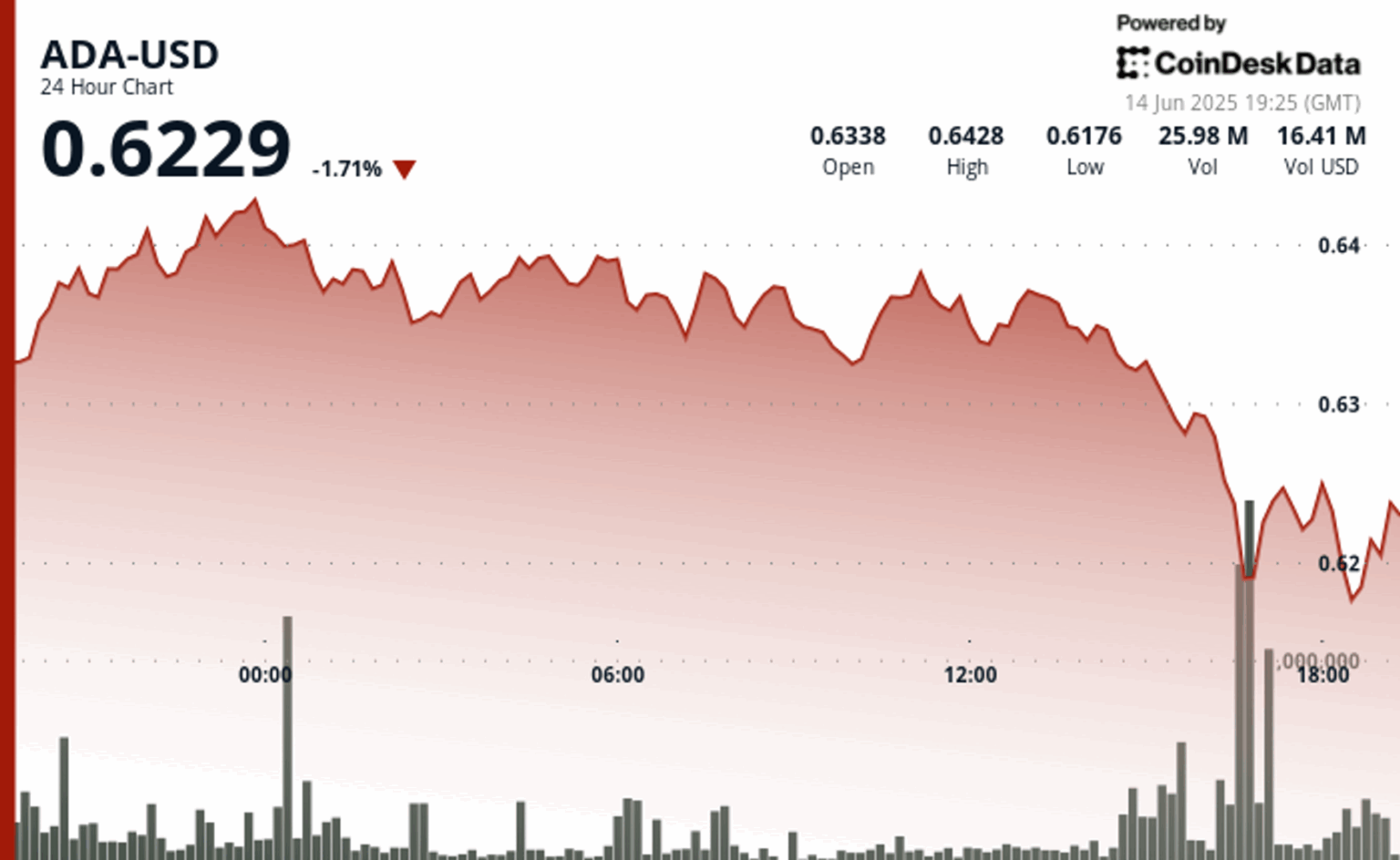

In recent trading sessions, Cardano’s native token, ADA, has demonstrated resilience despite significant sell-offs by major investors. As of June 14, 2025, ADA traded close to $0.62, experiencing a modest decline of approximately 1.7% over the past 24 hours. The token briefly dipped to around $0.6176 but quickly regained footing, reflecting a cautious market sentiment amid heightened volatility.

Market data indicates that large-scale holders, often referred to as whales, have offloaded over 270 million ADA tokens-equivalent to roughly $170 million-within a short period. This substantial liquidation has exerted downward pressure on ADA’s price, especially during a week characterized by geopolitical uncertainties and macroeconomic shifts that have heightened risk aversion among investors.

Strategic Launch: Originate’s Role in Enhancing Enterprise Adoption

Despite the turbulent trading environment, the Cardano Foundation has taken proactive steps to bolster the blockchain’s enterprise appeal. Recently, the organization introduced Originate, a blockchain-based platform designed to authenticate product origins and verify authenticity. This innovative solution aims to streamline supply chain compliance, reduce counterfeiting, and foster greater transparency for businesses.

Originate enables companies to digitize critical product data, creating an immutable record on the blockchain that can be instantly verified by consumers, regulators, and partners. This development aligns with broader industry trends emphasizing supply chain transparency, especially in sectors like luxury goods, pharmaceuticals, and food safety, where authenticity verification is paramount.

The Foundation emphasizes that Originate is tailored to reinforce brand trust and meet regulatory standards, positioning Cardano as a key player in enterprise-grade blockchain solutions. Such initiatives are increasingly vital as investors seek tangible, real-world applications of blockchain technology beyond traditional DeFi and staking platforms.

Broader Market Context: Institutional Recognition and Index Inclusion

The recent addition of ADA to the Nasdaq Crypto Index marks a significant milestone, signaling growing institutional confidence in Cardano’s ecosystem. Joining giants like Bitcoin and Ethereum, ADA’s inclusion underscores its potential as a mainstream digital asset. However, short-term market sentiment remains fragile, influenced by whale activity and broader macroeconomic headwinds that favor risk-off strategies.

Nevertheless, the move to integrate ADA into prominent indices could provide a foundation for sustained institutional interest, potentially stabilizing its price trajectory over the long term. As the ecosystem matures, increased adoption by enterprises and inclusion in major financial indices may serve as catalysts for future growth.

Technical Outlook: Navigating Resistance and Support Levels

From a technical perspective, ADA’s recent price action reveals a bearish trend, with the token oscillating between support at approximately $0.6176 and resistance near $0.6428. The closing price at $0.6229 reflects a daily loss, with the market experiencing heightened volume spikes after 18:00 GMT, coinciding with a dip below $0.62.

The pattern of lower highs and rejection at key resistance levels suggests ongoing bearish momentum. However, the market shows signs of short-term stabilization, although dominant whale activity continues to influence price direction. Traders should monitor support zones around $0.6176 and resistance levels near $0.645 for potential breakout or reversal signals.

Final Thoughts: Balancing Risks and Opportunities

While large-scale sell-offs by whales have temporarily pressured ADA’s price, Cardano’s strategic initiatives-such as the launch of Originate-highlight its commitment to real-world utility and enterprise integration. The token’s inclusion in major indices and ongoing development efforts could serve as catalysts for future resilience.

Investors should remain cautious amid macroeconomic uncertainties but also recognize the potential for long-term growth driven by enterprise adoption and institutional recognition. As the blockchain ecosystem continues to evolve, ADA’s trajectory will likely depend on how effectively it balances market volatility with tangible, scalable use cases.