Bitcoin Surges Past $110,000: A Pivotal Moment in Cryptocurrency’s Next Major Move

Market Experts Describe Recent Bitcoin Rally as a “Steady Ascension” Amid Growing Optimism

Updated June 10, 2025, 12:18 p.m. | Published June 9, 2025, 9:31 p.m.

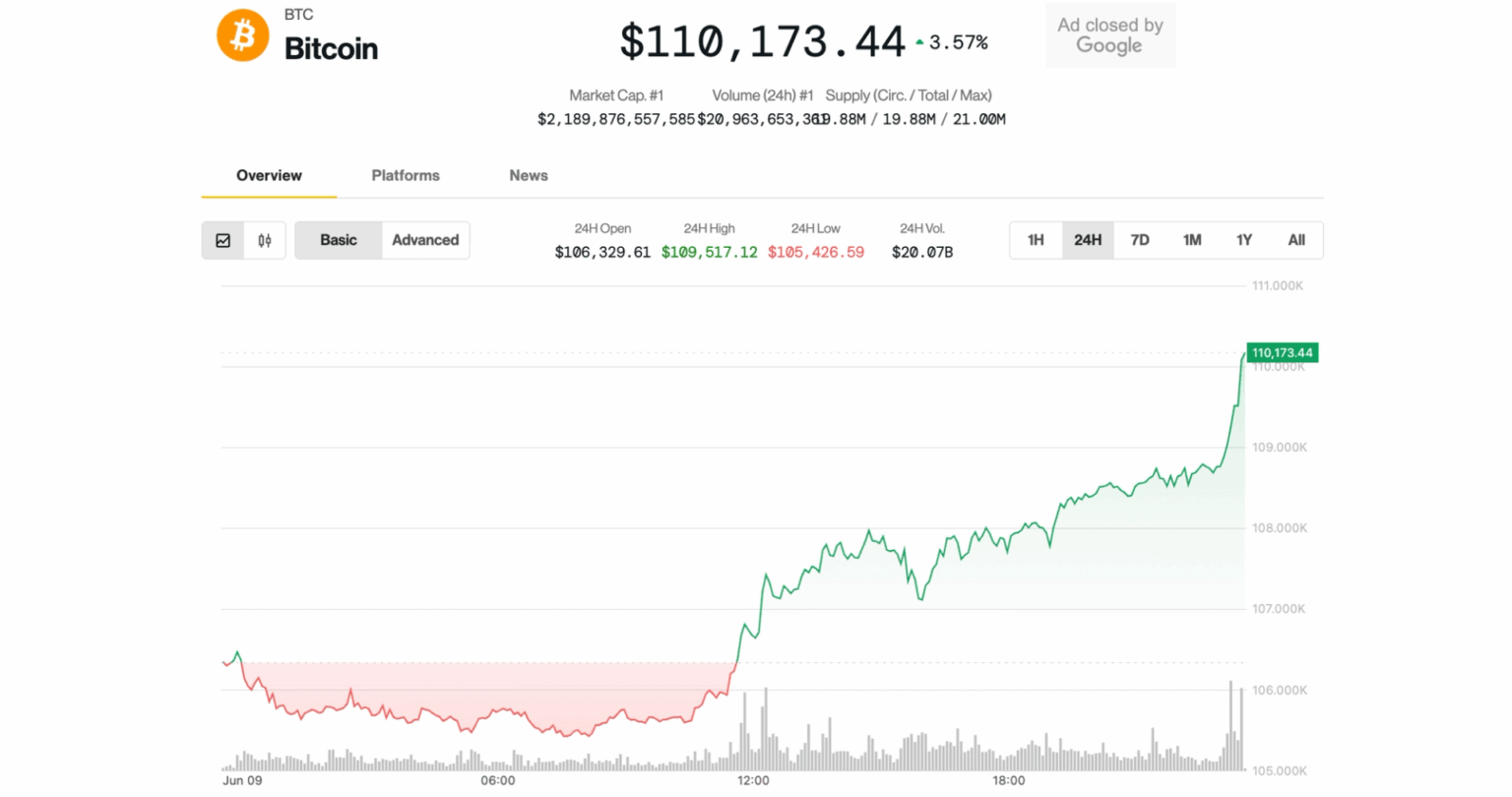

Bitcoin has experienced a remarkable upward trajectory this week, breaking through the $110,000 threshold and marking its most robust rally in June. This rebound follows a significant dip last week, signaling a potential shift in market momentum.

Over the past 24 hours, Bitcoin has appreciated by approximately 3.7%, pushing its value beyond the $110,000 mark. This surge places it just 2% shy of the all-time high recorded in May, highlighting renewed investor confidence. Meanwhile, Ethereum’s native token, Ether, mirrored this bullish trend with a 3.8% increase, trading above $2,620.

Emerging altcoins such as Hyperliquid and SUI outperformed many of the larger-cap cryptocurrencies, with gains of 7% and 4.5%, respectively, indicating a broad-based rally across the crypto landscape.

The rapid ascent of Bitcoin caught many leveraged traders off guard, leading to a liquidation of over $110 million worth of short positions within a single hour, according to data from CoinGlass. Overall, approximately $330 million in short positions across the entire crypto market were liquidated during the day, marking the highest monthly figure. Short sellers aim to profit from declining prices, and their rapid unwinding suggests a shift in market sentiment.

This upward movement occurred against a backdrop of relatively subdued traditional markets, with the S&P 500 and Nasdaq indices remaining flat. Interestingly, crypto-related equities experienced a bounce, aligning with Bitcoin’s weekend rally and reinforcing the interconnectedness of digital assets and traditional financial markets.

Expert Perspectives: A “Gradual and Confident” Market Recovery

Caleb Franzen, founder of Cubic Analytics, described the recent price action as a “peaceful rally,” emphasizing its steady nature characterized by higher highs and higher lows. “This kind of movement suggests a resilient trend, where buyers consistently step in to support the upward trajectory, even when signs of weakness appear,” he explained.

Following Bitcoin’s sharp 10% decline to around $100,000 last week, the market now appears to be stabilizing, with over $1.9 billion in liquidations across crypto derivatives during the past week. This purge of highly leveraged positions has helped establish a more solid foundation for future gains, according to Bitfinex analysts.

However, they also caution that on-chain data indicates increasing selling pressure from long-term holders, which could potentially counteract the current bullish momentum. This dynamic suggests that Bitcoin is at a critical juncture-balancing between structural support and diminishing bullish enthusiasm, awaiting a key macroeconomic trigger.

Upcoming Catalysts and Market Outlook

Market analysts, including Jake O. from Wintermute, highlight upcoming macroeconomic events that could influence Bitcoin’s trajectory. “The scheduled meeting between U.S. and Chinese trade representatives today is likely to generate market volatility, especially if any headlines emerge that could impact investor sentiment,” he noted.

Additionally, the release of the U.S. Consumer Price Index (CPI) data on Wednesday is expected to provide fresh insights into inflation trends, which historically have a significant impact on both traditional and crypto markets. These macro factors could serve as the next catalysts for a sustained rally or a correction.

Update (June 9, 21:51 UTC): Additional short liquidation data from CoinGlass has been incorporated to provide a comprehensive view of market activity.

Market Analysis and Future Expectations

As Bitcoin approaches a critical crossroads, the market remains cautiously optimistic. The recent correction and subsequent recovery suggest a maturing market that is increasingly driven by institutional participation and macroeconomic factors. The next few weeks will be pivotal in determining whether the current rally can sustain or if a retracement is imminent.

With Bitcoin’s market cap now exceeding $2.2 trillion, and institutional interest continuing to grow-evidenced by recent investments from major firms-the cryptocurrency ecosystem is entering a new phase of maturity. This environment could foster more stable growth, provided macroeconomic conditions remain favorable.

About the Author

Krisztian Sandor

Krisztian Sandor is a seasoned financial journalist specializing in U.S. markets, with a focus on stablecoins, tokenization, and global assets. An alumnus of New York University’s business and economic reporting program, he has been covering the evolving crypto landscape for several years. Krisztian holds investments in Bitcoin, Solana, and Ethereum, reflecting his deep engagement with digital assets.