Essential Highlights:

- Over the past 24 hours, Bitcoin experienced a decline exceeding 2%, dropping below the $101,000 mark before partially rebounding.

- Approximately $1 billion worth of leveraged long positions were liquidated, impacting over 220,000 traders globally.

- Market sentiment has been subdued by escalating geopolitical tensions and high-profile disputes among influential figures.

The recent downturn in Bitcoin’s price has triggered a wave of liquidations and a volatile trading environment. This article examines the underlying causes, the scale of forced liquidations, and how international political developments are influencing trader behavior in the crypto space.

Explore More: Crypto Market Resilience Shaken as Elon Musk and Political Figures Clash – Are You Prepared?

Bitcoin’s Price Collapse Sparks Massive Liquidations

Within less than a day, Bitcoin’s value plummeted from approximately $105,000 to nearly $100,900, breaching a critical psychological threshold that triggered widespread panic selling. This sharp decline set off a cascade of forced liquidations across crypto derivatives markets, totaling close to $1 billion in leveraged long positions being wiped out.

Breakdown of Liquidation Events

Data from analytics firm Coinglass indicates that around 228,000 traders faced liquidation, incurring losses close to $985 million. Long positions bore the brunt, with $889 million in liquidations, while short positions accounted for roughly $97 million.

One notable event involved a single liquidation on BitMEX’s flagship instrument, the Bitcoin perpetual contract (XBTUSD), with a position size nearing $10 million. These figures underscore the extreme volatility and risks associated with leveraged crypto trading during rapid market shifts.

External Factors Fueling Market Turbulence

The recent price decline did not occur in isolation. Several macroeconomic and geopolitical factors have contributed to heightened investor anxiety:

- Resurgence of US-China Trade Tensions: Recent signals suggesting a tougher stance by the US towards China have reignited fears of trade conflicts, prompting risk-off sentiment across markets. Such geopolitical frictions often lead investors to liquidate risky assets swiftly, including cryptocurrencies, to mitigate potential losses.

Learn More: Trump’s Tariff Strategies Spark New Rally for Bitcoin and Altcoins Amid Market Uncertainty

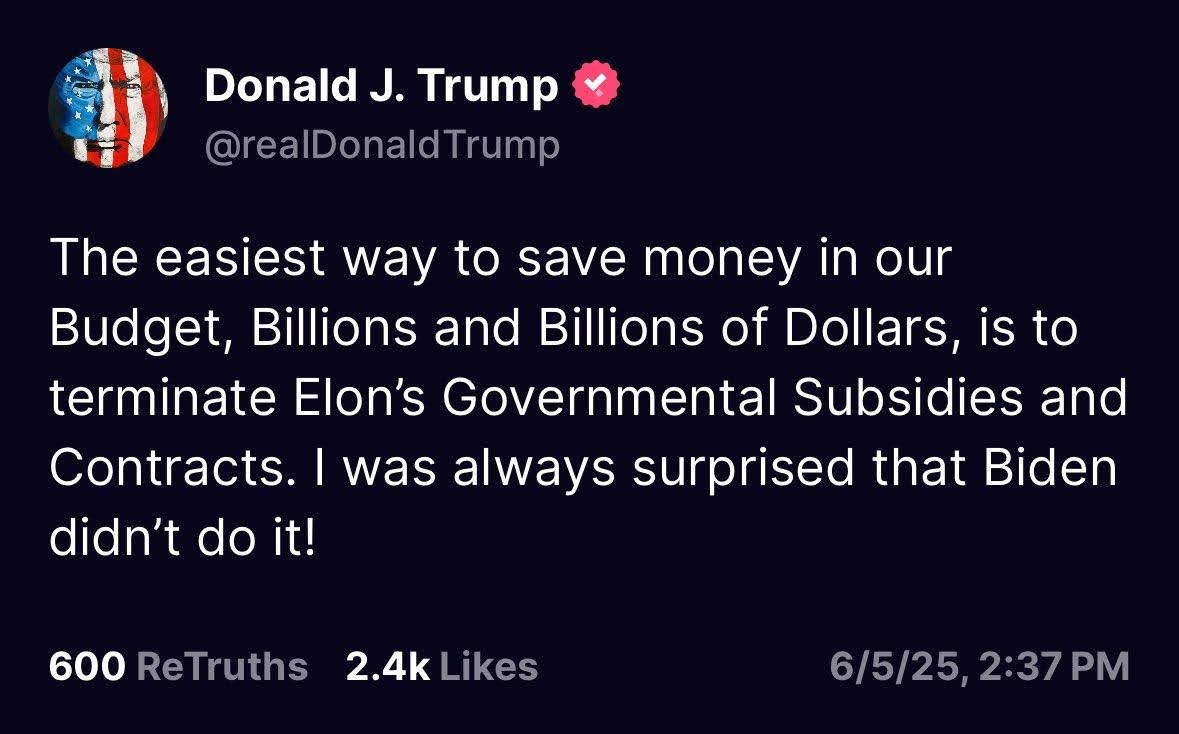

- Public Disputes Among Influential Figures: The widely publicized feud between Tesla CEO Elon Musk and former US President Donald Trump on social media further amplified market unease. Musk’s allegations linking Trump to confidential documents added to the narrative of instability, influencing investor confidence.

These external pressures have converged to create an environment ripe for rapid price swings and increased market volatility.

Trading Volume Surges Amid Price Decline

In response to the sharp price drop, Bitcoin’s trading volume surged by approximately 36.6%, reaching around $60.4 billion. This spike indicates that traders actively engaged in closing out positions or initiating new trades amid the turbulent conditions, seeking to capitalize on the volatility or limit their exposure.

Despite the turbulence, Bitcoin’s market capitalization remains robust at roughly $2.03 trillion, with nearly 19.9 million BTC in circulation. This resilience suggests that many investors continue to view Bitcoin as a valuable asset, maintaining high liquidity even during downturns.

Impact of Leverage and Liquidation Dynamics

Leverage magnifies market movements: when prices decline, traders who have borrowed funds to amplify their positions face automatic liquidation if the value of their collateral drops below certain thresholds. This process can trigger a domino effect, where liquidations push prices further downward, prompting additional forced sales.

The nearly $1 billion in liquidations highlights the importance of prudent risk management and position sizing in crypto trading. The recent rapid decline caught many traders off guard, emphasizing the need for caution in highly leveraged environments.

Implications for Crypto Investors

- Risk Management: Traders employing leverage should exercise heightened caution, as geopolitical developments can swiftly reverse bullish trends and trigger sharp downturns.

- Volatility as a Trading Opportunity: Increased trading activity and liquidations can create opportunities for long-term investors to acquire assets at discounted prices once panic subsides.

- Market Sentiment Sensitivity: Cryptocurrency markets are highly reactive to global news and social media narratives, which can cause sudden shifts in price direction. Staying informed and adaptable is crucial.

Will Bitcoin Find Its Footing Soon?

While Bitcoin’s price remains below key resistance levels, technical analysis indicates strong support around the $100,000 mark, suggesting a potential stabilization in the near term. Additionally, increasing institutional interest and positive on-chain metrics point to a resilient underlying network that could facilitate a swift recovery.

Nevertheless, ongoing geopolitical uncertainties could prolong volatility, urging traders and investors to remain vigilant. Monitoring both macroeconomic indicators and crypto-specific signals is essential for navigating this unpredictable landscape.

This episode underscores the inherent risks and complexities of cryptocurrency trading, especially under high leverage conditions. Maintaining disciplined trading strategies and staying updated with relevant news are vital for weathering sudden market shifts effectively.