Essential Highlights:

- Effective June 13, 2025, Coinbase will facilitate round-the-clock trading of XRP and Solana futures, enabling U.S. traders to engage in continuous market activity every day of the week. This move ensures uninterrupted access to these high-demand cryptocurrencies.

- By adopting this approach, Coinbase positions itself as the leading U.S.-regulated platform under the Commodity Futures Trading Commission (CFTC) to offer 24/7 futures trading for these prominent altcoins.

- The primary goal is to tap into the daily trading volume of approximately $3.3 billion for XRP and Solana, which is expected to enhance market liquidity and foster a more efficient trading environment.

The cryptocurrency trading landscape is constantly evolving, yet many U.S.-based futures exchanges restrict trading hours, limiting market accessibility. Coinbase’s initiative to enable 24/7 futures trading for XRP and Solana addresses this gap, providing traders worldwide with the flexibility to respond instantly to market shifts, global news, or sudden price movements. These two cryptocurrencies are among the most actively traded, making this development particularly significant for institutional investors and retail traders seeking continuous market engagement.

Discover More: Coinbase Breaks Barriers: First U.S. Crypto Company to Join the S&P 500 Index

Transitioning to Continuous Altcoin Futures Trading

Coinbase’s decision to enable 24/7 trading for XRP and Solana futures stems from the surging demand for cryptocurrency derivatives. Previously, the platform only offered around-the-clock trading for Bitcoin and Ethereum futures. Expanding to include XRP and Solana signifies a strategic move to serve the next tier of highly traded digital assets.

Starting June 13, we will provide 24/7 trading for XRP and Solana futures, granting U.S. traders immediate access and reflecting the nonstop nature of crypto markets.

– Coinbase Institutional 🛡️ (@CoinbaseInsto) May 29, 2025

This move bridges the gap between traditional U.S. trading hours and the global 24-hour crypto markets. Traders can react swiftly to market developments, geopolitical events, or breaking news, leading to faster market responses and more comprehensive tools for managing positions throughout the day. Continuous futures trading for XRP and Solana caters to the needs of traders who demand high liquidity and instant access to these markets, enabling hedging, speculation, and arbitrage strategies based on their substantial trading volumes and market caps.

Learn More: 8 Popular Tokens Recently Launched on Coinbase – But Only Available in One Country

Understanding Market Size and Trading Dynamics

XRP and Solana rank among the top altcoins by market capitalization and daily trading volume. XRP’s global daily trading volume exceeds $1.5 billion, with Solana not far behind. The futures markets for these assets have been steadily expanding, with derivatives trading now constituting a significant portion of overall crypto activity worldwide.

Since Coinbase’s XRP and Solana futures are settled in USD, the process is simplified, eliminating the need for token transfers. For example, a single XRP futures contract might represent 10,000 XRP tokens, allowing traders to fine-tune their investments according to their risk appetite. Similarly, Solana futures are structured to reflect the asset’s liquidity and volatility, providing tailored trading options.

To mitigate typical market risks, Coinbase has implemented automatic trading halts if a cryptocurrency experiences a 10% price fluctuation within an hour. This safeguard helps prevent manipulation and excessive volatility, protecting both the platform and its users.

Regulatory Oversight and Institutional Trust

Coinbase’s regulation by the Commodity Futures Trading Commission (CFTC) distinguishes it from many other exchanges. This oversight ensures compliance with U.S. derivatives trading laws, fostering transparency and accountability. Such regulatory backing reassures institutional investors, who often prefer platforms with strict oversight to safeguard their capital and ensure market integrity.

Adherence to CFTC regulations helps prevent market manipulation and fraud, creating a safer environment for large-scale investors. This regulatory framework is crucial for attracting significant institutional participation, which is vital for the maturation of the crypto derivatives market.

Competitive Positioning in the Futures Market

The futures trading sector is becoming increasingly competitive, with more platforms entering the fray. The Chicago Mercantile Exchange (CME) recently launched XRP futures, recording daily volumes surpassing $19 million during its initial trading days. However, CME’s offerings are currently limited to specific hours, unlike Coinbase’s 24/7 service.

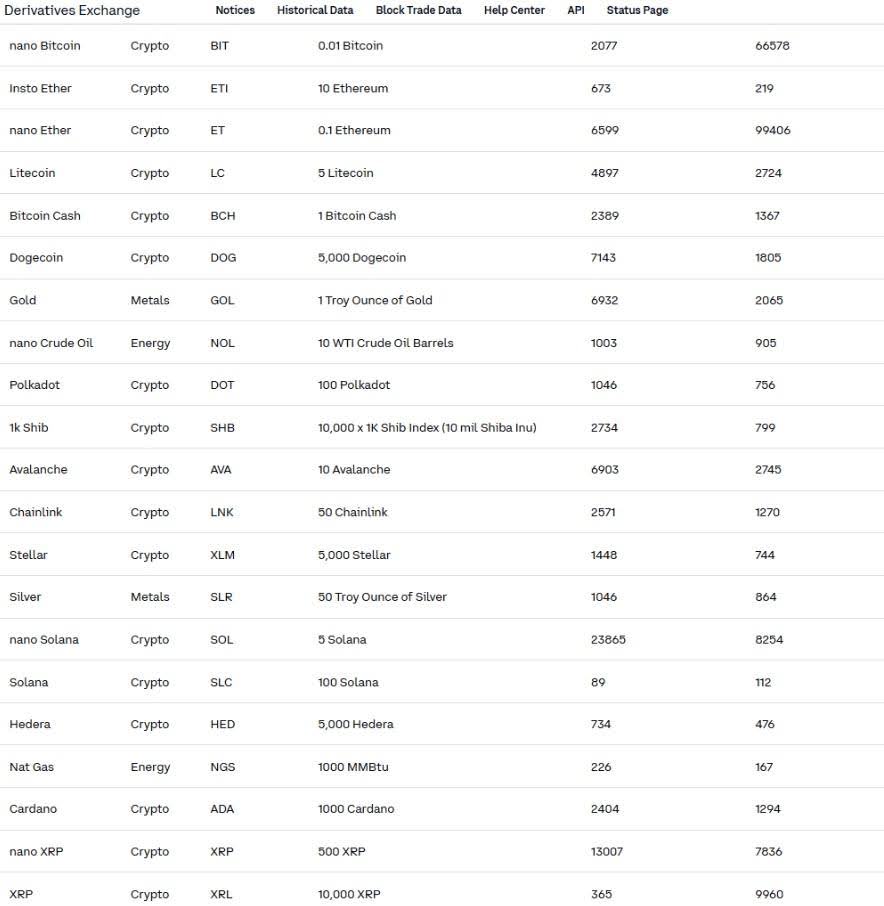

Coinbase’s continuous trading model appeals to traders seeking maximum flexibility and liquidity outside traditional hours. Additionally, Coinbase plans to expand its futures portfolio to include other promising cryptocurrencies like Cardano (ADA) and Hedera (HBAR), broadening opportunities for traders to diversify their derivative exposure.

Market Benefits and Trader Impact

The introduction of round-the-clock futures trading offers numerous advantages for the crypto trading community:

- Enhanced Market Liquidity: Increased trading activity reduces bid-ask spreads and results in more accurate pricing.

- Better Price Discovery: Continuous trading minimizes gaps, providing clearer insights into supply and demand dynamics globally.

- Risk Management: Traders can swiftly adjust their positions in response to market shifts, reducing exposure to adverse movements.

- Broader Market Participation: The 24/7 availability encourages more traders worldwide to engage, fostering a more inclusive trading environment.

By integrating innovative features like 24/7 futures trading, Coinbase is advancing the maturity of the crypto derivatives market. These developments not only improve market transparency but also demonstrate how digital asset trading is becoming increasingly interconnected and dynamic across the globe.