Ethereum and Bitcoin Cement Their Role as Pillars of Global Financial Infrastructure, According to Industry Leaders

Ethereum’s Rising Significance as a Financial Foundation

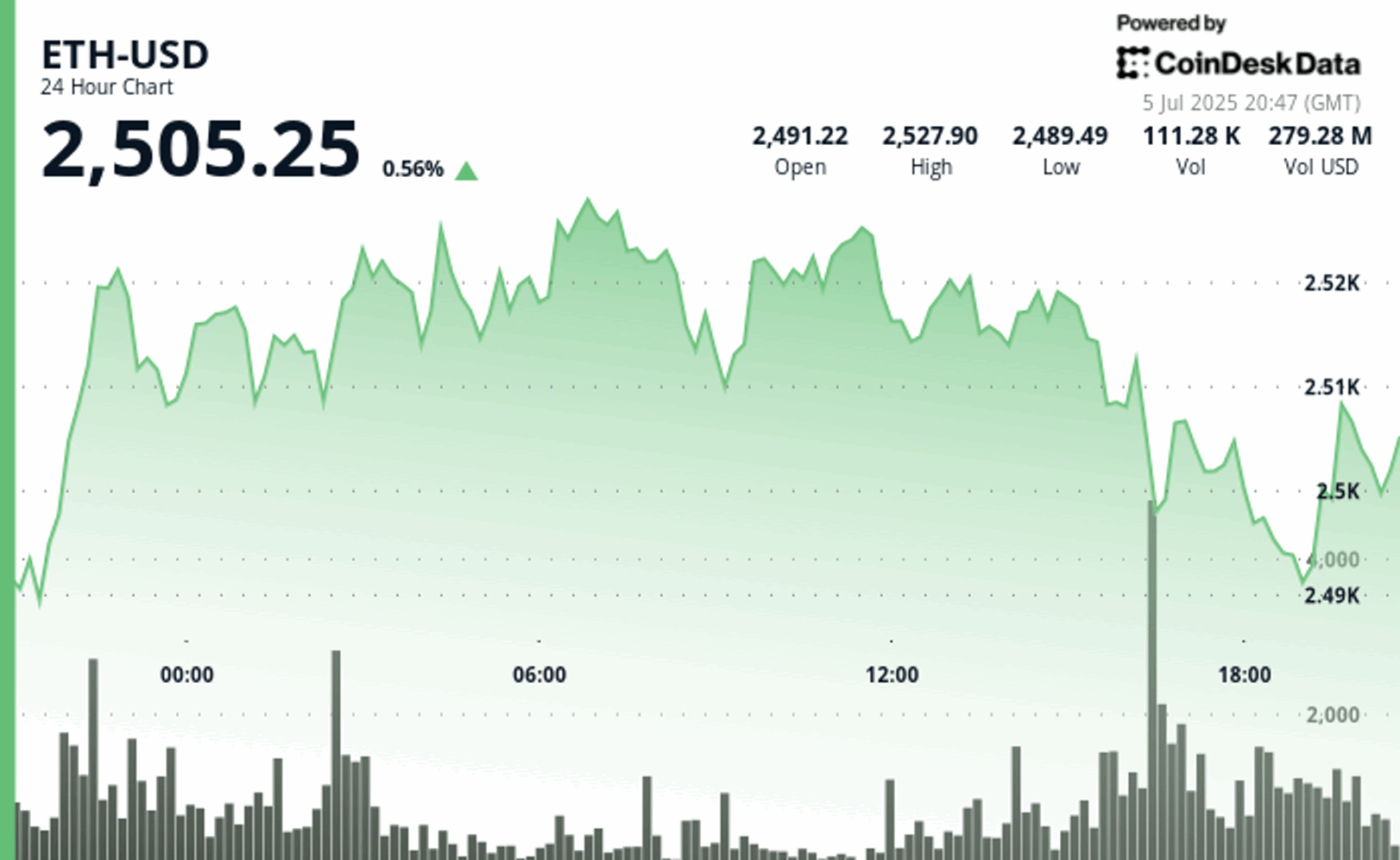

As of the latest market data, Ethereum (ETH) is trading near $2,505, reflecting a modest increase of approximately 0.56% over the past 24 hours, based on CoinDesk Research’s technical analysis. Meanwhile, the broader cryptocurrency landscape, as represented by the CoinDesk 20 Index (CD20), has experienced a slight uptick of 0.34% during the same period. These figures underscore Ethereum’s resilience amid fluctuating market conditions, reinforcing its emerging status as a core component of the digital economy.

SharpLink Gaming’s Strategic Shift Toward Ethereum

Founded in Minneapolis, SharpLink Gaming, Inc. (SBET) is a trailblazing enterprise in the online sports betting and iGaming sectors. The company leverages advanced artificial intelligence through its proprietary C4 platform to craft tailored marketing campaigns that boost customer engagement and retention for sportsbooks and online casinos. Over recent years, SharpLink has grown significantly through strategic acquisitions and collaborations, positioning itself at the forefront of the rapidly evolving sports betting industry.

On July 4, 2025, the company announced a groundbreaking move: it has become the first publicly traded firm to designate Ethereum as its primary treasury reserve asset. This decision aligns with a broader vision to integrate blockchain technology into corporate finance, emphasizing ETH’s potential as a long-term store of value and growth driver.

A New Paradigm in Corporate Reserves

SharpLink’s treasury strategy is centered on actively deploying its ETH holdings through staking, restaking, and yield-generating protocols within the decentralized finance (DeFi) ecosystem. The company highlights several advantages of holding ETH as a corporate reserve: it offers productive rewards via staking, is highly composable across DeFi platforms, and benefits from scarcity and security-traits that make it an attractive alternative to traditional cash reserves. This approach signifies a paradigm shift, blending conventional treasury management with innovative decentralized finance principles.

The company’s bold move was catalyzed by a $425 million private placement announced on May 27, 2025, led by industry heavyweight ConsenSys and other prominent crypto investors. Ethereum co-founder Joseph Lubin, also the founder of ConsenSys, joined SharpLink’s Board of Directors as Chairman, further cementing the company’s commitment to blockchain innovation.

Accelerated ETH Accumulation and Deployment

Since initiating its ETH treasury strategy on June 2, 2025, SharpLink has rapidly increased its holdings. Between May 30 and June 12, the company acquired approximately 176,271 ETH for around $463 million, averaging a purchase price of $2,626 per ETH. Subsequently, from June 16 to June 20, an additional 12,207 ETH were purchased for roughly $30.7 million, partly financed through At-The-Market (ATM) equity sales raising $27.7 million.

By late June, SharpLink’s ETH reserves had grown to 188,478, with all assets actively staked to generate ongoing rewards. As of July 1, the total ETH holdings reached nearly 200,000, yielding over 220 ETH in staking rewards since the inception of this strategy. The company’s leadership emphasizes that this approach not only enhances liquidity but also aligns with the future of internet infrastructure, which is increasingly built on blockchain technology.

Leadership Perspectives and Market Outlook

Joseph Lubin has articulated that integrating Ethereum into SharpLink’s core financial strategy exemplifies technological progress and institutional trust, positioning the company as a leader in digital commerce. Meanwhile, CEO Rob Phythian has announced that the upcoming Nasdaq closing bell ceremony on July 7, 2025, will serve as a symbolic milestone-highlighting how digital assets can coexist with traditional market disciplines and corporate governance frameworks.

This innovative treasury approach places SharpLink at the intersection of sports betting, blockchain technology, and decentralized finance, offering investors regulated and transparent exposure to Ethereum’s growth trajectory. It also underscores the company’s broader mission to revolutionize the multi-billion-dollar iGaming industry through blockchain-enabled solutions.

Market Technicals and Short-Term Trends

Recent technical analysis reveals that ETH experienced a 2.2% increase from July 4 at 15:00 to July 5 at 14:00, climbing from $2,475.48 to $2,530.02. A brief sell-off occurred between 13:06 and 14:05, pushing ETH down to $2,514.85 before buyers regained control. Support levels have solidified between $2,480 and $2,500, with significant trading volume-over 382,821 ETH-during this period.

A bullish breakout was observed on July 4 at 22:00, pushing ETH above $2,520, with resistance near $2,530. The asset has since consolidated around $2,515, showing signs of reduced volatility and a steady recovery trend. While short-term momentum remains neutral, the overall market structure remains bullish, supported by a sustained upward trend since late June.

Final Thoughts: The Future of Digital Reserves

The strategic adoption of Ethereum by companies like SharpLink signals a transformative shift in how corporations view digital assets. As blockchain technology continues to mature and integrate into mainstream finance, Ethereum’s role as a foundational layer for global economic systems is becoming increasingly evident. Industry experts predict that more firms will follow suit, leveraging ETH’s unique properties to enhance liquidity, security, and growth potential in their corporate reserves.

Disclaimer: Portions of this article were generated with AI assistance and reviewed by our editorial team to ensure accuracy and compliance with journalistic standards. For further details, please refer to CoinDesk’s full AI Policy.