Deciphering the Latest Inflation Trends and Their Impact on Federal Monetary Policy

Recent data indicates that the most accurate gauge of inflation, as perceived by the Federal Reserve, continues to show a steady decline. However, the broader economic environment that might prompt a reduction in interest rates is becoming increasingly unpredictable and complex.

Current Inflation Metrics and Consumer Spending Patterns

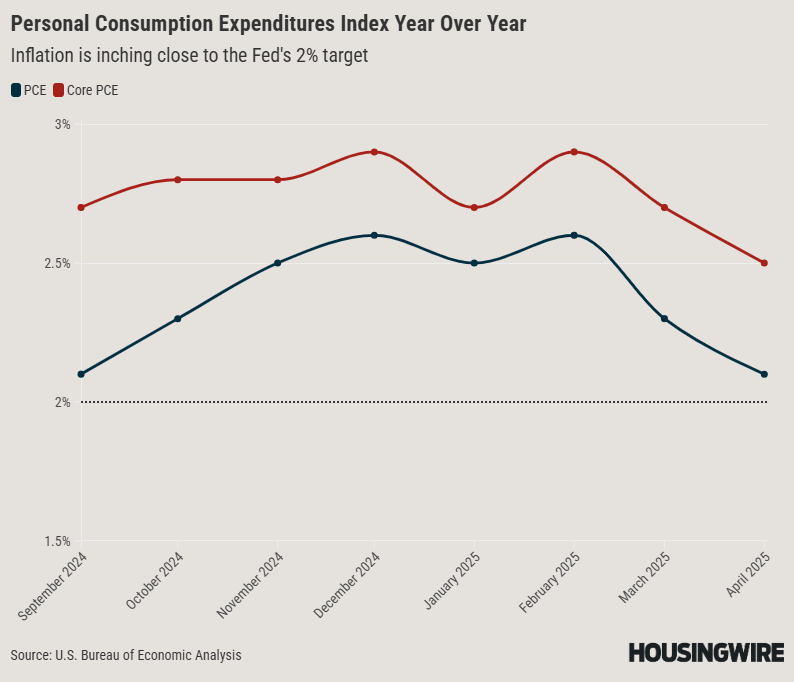

According to the latest figures from the U.S. Bureau of Economic Analysis (BEA), the Personal Consumption Expenditures (PCE) price index for April increased by 2.1% on an annual basis, slightly below March’s 2.3% and nearing the Fed’s target of 2%. Month-over-month, the index rose by 0.1%, following a flat reading in March, indicating a modest acceleration in consumer prices.

Core inflation, which excludes volatile food and energy costs, registered a 2.5% annual increase-the lowest rate observed so far in 2025. The housing sector remains the primary contributor to individual expenditure, with a notable rise of $24.7 billion on a seasonally adjusted annual basis, underscoring the ongoing importance of real estate in consumer budgets.

Implications of Falling Inflation on Monetary Policy

In isolation, these declining inflation figures could suggest that the Federal Reserve is poised to lower interest rates, aligning with Chairman Jerome Powell’s longstanding stance that rate cuts should only occur once inflation stabilizes around 2%. However, the current economic landscape presents a more complicated picture.

Geopolitical and Legal Factors Clouding the Outlook

This week, two federal courts temporarily halted the implementation of tariffs introduced by former President Trump on April 2, ruling that the authority invoked-the International Economic Emergency Powers Act (IEEPA)-does not grant the president unilateral power to impose such measures. Meanwhile, a federal appeals court granted a stay on this ruling, allowing the tariffs to remain in effect for now, though the legal debate is expected to escalate to the Supreme Court.

It’s important to note that these rulings do not impact tariffs on specific goods, such as the 25% duties on steel and aluminum imports, which remain in place. These tariffs are widely expected to exert upward pressure on inflation, a factor that Powell has repeatedly acknowledged as a consideration in his monetary policy decisions. Consequently, the Fed might adopt a more cautious approach to interest rate reductions.

Housing Market Challenges and Mortgage Rate Trends

The housing sector continues to face headwinds, a trend that has persisted since 2022 when the Fed raised rates to combat inflation driven by pandemic-related supply chain disruptions. Currently, HousingWire’s Mortgage Rates Center reports a 30-year fixed mortgage rate at approximately 6.99%, and a 15-year conforming mortgage at around 6.82%. These rates have decreased by about 4 basis points over the past week and are 8 basis points lower than two weeks prior. Notably, 15-year conforming loan rates have fallen by 10 basis points in the last fortnight, standing at 7.32% as of Tuesday.

Political Pressure and Market Expectations

President Trump continues to exert pressure on Powell regarding interest rates. During a recent meeting, Trump expressed his belief that the Fed should lower rates, asserting that “enough is enough.” Additionally, FHFA Director Bill Pulte publicly stated that Powell should consider rate cuts, emphasizing that the current stance is overly restrictive.

While the BEA’s latest report shows a positive trend with the Consumer Price Index (CPI) rising by 2.3% annually in April, this data alone is unlikely to sway the Fed’s cautious stance on monetary policy. The central bank remains wary of external factors, such as tariffs, whose full impact on inflation may not be evident until later this summer. Many corporations, including retail giants like Wal-Mart, have signaled that they are already raising prices in anticipation of these tariffs, but the tangible effects on inflation are expected to materialize gradually over the coming months.