Reevaluating XRP Amidst Shifting Market Dynamics and U.S. Inflation Data

Market Overview: Bitcoin, Gold, and Equity Indices

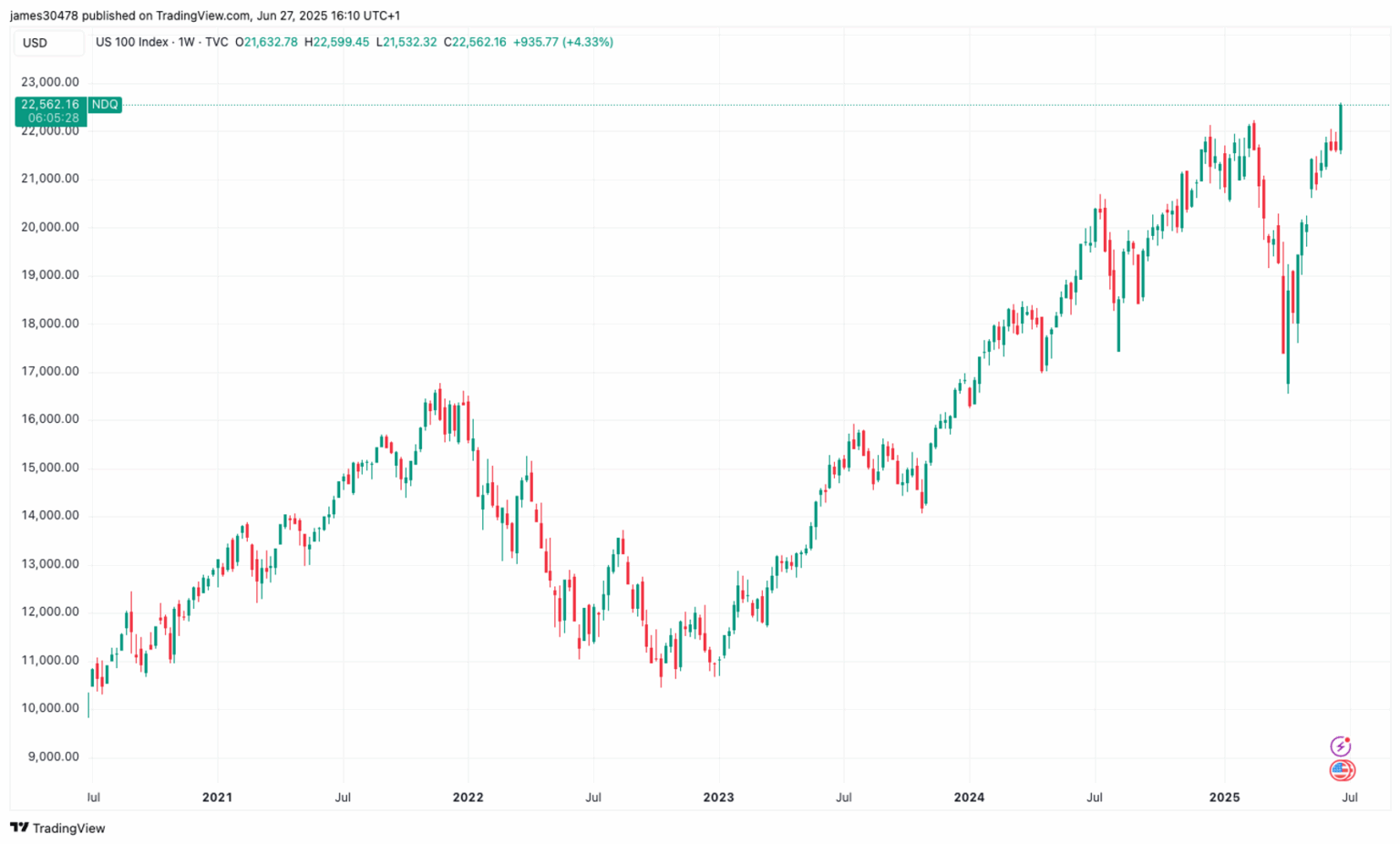

As of late June 2025, Bitcoin remains in a consolidation phase, trading within a narrow band of approximately $102,000 to $108,000. Meanwhile, gold has experienced a decline of about 2% today, representing roughly a 7% decrease from its all-time high. Contrasting these movements, the Nasdaq 100 index has surged to new record levels, reflecting ongoing investor confidence in technology and growth stocks.

The Impact of Outdated U.S. Economic Indicators

Recent macroeconomic data from the United States, though now nearly two months old, continue to influence market sentiment. Personal income figures for May revealed a contraction of 0.4%, falling short of the anticipated 0.3% increase. Similarly, personal consumption expenditures declined by 0.1% month-over-month, missing the forecasted 0.1% growth. These figures suggest a slowdown in consumer spending and income, raising concerns about economic momentum.

Inflation Trends and Federal Reserve Indicators

More critically, the core Personal Consumption Expenditures (PCE) price index-an essential metric for the Federal Reserve that excludes volatile food and energy prices-posted a 0.2% increase in May, surpassing the expected 0.1%. On an annual basis, core PCE inflation accelerated to 2.7%, slightly above the projected 2.6%. This uptick in underlying inflationary pressures fuels speculation that the economy might be edging toward stagflation-a scenario characterized by stagnant growth coupled with rising prices.

Market Reactions and Expert Perspectives

The release of these inflation signals has prompted a cautious stance among investors. Notably, gold prices have continued to decline despite weak economic data, as traders anticipate that persistent inflation and a weakening dollar could eventually bolster gold’s appeal. Veteran market analyst and gold advocate Peter Schiff remarked, “Even with subdued economic indicators, the dollar index has hit new lows, and stagflation remains a looming threat. Gold remains a safe haven in such turbulent times, regardless of superficial trade negotiations.”

The Broader Economic Context

The current environment underscores the complex interplay between inflation, monetary policy, and asset prices. While equities like the Nasdaq 100 reach new heights, traditional safe-havens such as gold face downward pressure amid mixed signals. The divergence highlights the importance of understanding macroeconomic fundamentals and their influence on various asset classes.

About the Author

James Van Straten is a senior analyst at CoinDesk, with a focus on Bitcoin’s relationship with macroeconomic trends. His previous experience includes working as a research analyst at Saidler & Co., a Swiss hedge fund, where he specialized in on-chain analytics. James’s insights are rooted in monitoring capital flows and assessing Bitcoin’s role within the broader financial ecosystem. He also advises Coinsilium, a UK-based publicly traded company, on Bitcoin treasury strategies and maintains personal investments in Bitcoin and related assets.

Note: The information provided reflects the latest available data and market analysis as of June 2025. Investors should conduct their own research and consider multiple sources before making financial decisions.