Market Update: Bitcoin Hits New Milestone Amid Broader Cryptocurrency Rally

Published: July 10, 2025, 4:54 p.m. | Updated: July 10, 2025, 4:54 p.m.

Cryptocurrency Market Surge: Bitcoin Reaches Historic Highs

In a remarkable development, Bitcoin has surged past the $112,000 mark, setting a new all-time high and fueling optimism across the digital asset landscape. This milestone underscores the growing institutional interest and the increasing mainstream acceptance of cryptocurrencies. As Bitcoin continues to dominate headlines, other digital tokens are also experiencing notable gains, signaling a potential shift into a new phase of market exuberance.

Focus on NEAR Protocol: Recent Price Movements and Technical Insights

Price Dynamics and Trading Volume

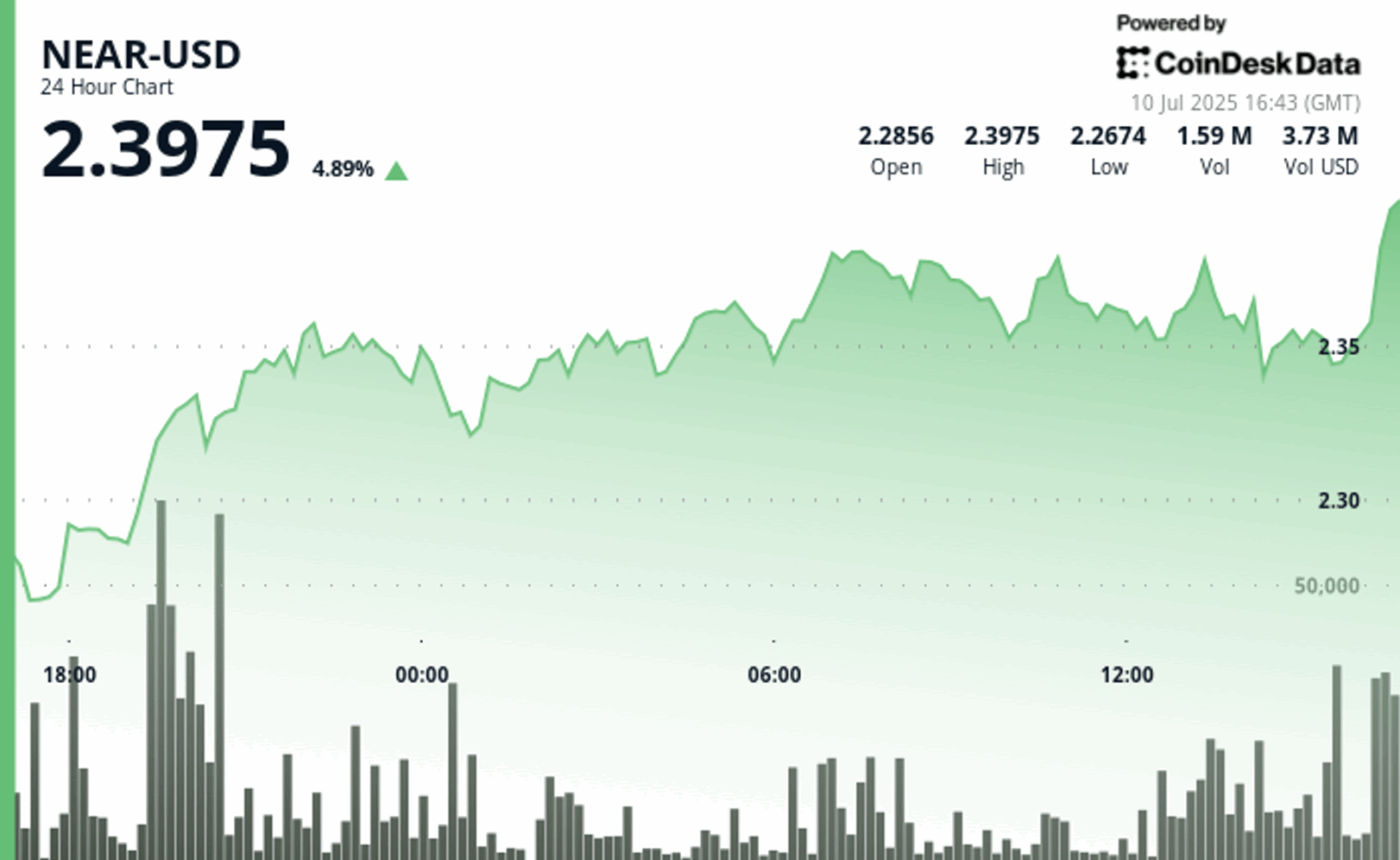

Over the past 24 hours, the NEAR Protocol has demonstrated a bullish trend, climbing from $2.26 to a peak of $2.38 before settling at approximately $2.34. This movement represents a 5.04% increase within a narrow trading range of $0.12. The most active trading occurred during the evening of July 9, around 7:00 PM, when trading volume hit 4.62 million units-almost three times the average daily volume of 1.73 million. Such heightened activity indicates strong investor engagement and helps establish a solid technical support level at $2.29.

Market Sentiment and Institutional Activity

The session also revealed strategic moves by institutional traders. Volatility observed between 2:58 PM and 3:57 PM on July 10 suggests profit-taking by large players, followed by strategic buy-ins, reflecting a sustained bullish outlook. This pattern indicates confidence among sophisticated investors that the upward momentum is likely to persist.

Broader Market Context: Bitcoin’s Record High and Altcoin Season Anticipation

The recent breakthrough of Bitcoin’s price above $112,000 marks a significant milestone, reinforcing its position as the leading cryptocurrency. This surge comes amid widespread anticipation of an upcoming altcoin season, where alternative tokens are expected to outperform Bitcoin. Industry analysts suggest that the current bullish sentiment could catalyze a broader rally across the crypto market, driven by increased institutional participation and retail investor enthusiasm.

Technical Analysis: Key Indicators and Market Support Zones

- Price Range and Volatility: The $0.12 movement from $2.26 to $2.38 highlights a 5% price fluctuation, signaling active trading and volatility.

- Volume Spikes: The surge to 4.62 million units during peak hours underscores heightened market participation, surpassing the 23-hour average of 1.73 million.

- Support Levels: Technical support has been firmly established at $2.29, with a new support zone forming around $2.34 following recent recoveries.

- Institutional Patterns: Notable profit-taking occurred briefly between 3:41 and 3:42 PM, yet overall activity confirms underlying bullish sentiment, with strategic buying reinforcing upward momentum.

Expert Perspectives and Market Outlook

Market analysts remain optimistic about the ongoing rally, citing Bitcoin’s record-breaking performance as a catalyst for broader market gains. The combination of technical support levels, increased trading volumes, and institutional activity suggests that the current bullish trend could sustain into the coming weeks. Investors are advised to monitor key support zones and volume indicators to gauge potential reversals or continued growth.

About the Authors

Oliver Knight is a seasoned market analyst and co-leader of CoinDesk’s data team. With a background that includes three years as chief reporter at Coin Rivet and experience working at a UK-based market-making firm, Oliver has been investing in cryptocurrencies since 2013. Despite his deep involvement in the industry, he currently holds no crypto assets.

CoinDesk Analytics leverages AI-powered tools combined with human oversight to produce accurate market insights, price analysis, and financial reports focused on cryptocurrencies and blockchain technology. All content undergoes rigorous editorial review to ensure transparency and reliability, adhering to CoinDesk’s AI content guidelines.

Disclaimer: Portions of this article were generated with AI assistance and reviewed by our editorial team to ensure accuracy and compliance with journalistic standards. For more details, please refer to CoinDesk’s full AI policy.