Meta’s Stance on Bitcoin: A Deep Dive into Shareholder Sentiment and Industry Trends

Key Insights at a Glance

- Majority Rejection of Bitcoin Adoption: The vast majority of Meta shareholders oppose the idea of integrating Bitcoin into the company’s treasury reserves, with less than 1% showing support.

- Preference for Liquidity Preservation: The company’s leadership and board members favor maintaining their current liquid assets, which total approximately $72 billion, rather than reallocating funds into cryptocurrencies.

- Institutional Caution Prevails: Despite Bitcoin’s growing acceptance and market stability, large institutional investors remain hesitant to incorporate digital assets into their corporate strategies.

During Meta’s recent annual shareholder meeting, a near-unanimous vote was cast against a proposal to explore the potential benefits of holding Bitcoin as part of the company’s financial reserves. This decision aligns with the broader cautious approach observed among major corporations regarding digital assets. While cryptocurrencies are gaining popularity among retail investors, many tech giants continue to exercise restraint when it comes to treasury management involving crypto assets.

Rejection of the Bitcoin Investment Proposal

On May 28, 2025, Meta’s shareholders decisively rejected a motion that proposed investigating the advantages of allocating a portion of the company’s $72 billion in cash, securities, and equivalents into Bitcoin. The initiative was introduced by Ethan Peck from the National Center for Public Policy Analysis, who argued that Bitcoin could serve as a hedge against inflation and declining real yields on traditional investments. Peck highlighted Bitcoin’s fixed supply and its historical appreciation as reasons for considering it a superior store of value compared to government bonds and other low-yield assets.

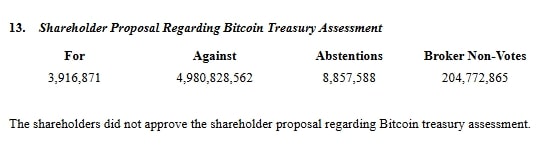

However, the voting results clearly demonstrated the prevailing sentiment: only about 3.9 million votes supported the proposal, while approximately 5 billion votes opposed it. Additionally, over 204 million dealer non-votes were recorded, underscoring the lack of institutional backing. The support for Bitcoin represented less than 0.1% of all votes cast, reflecting widespread skepticism among shareholders and institutional investors alike.

Related Reading: Texas Proposes Strategic Bitcoin Reserve Amid Push for Crypto Sovereignty

Meta’s Official Position: No Immediate Need for Bitcoin

Meta’s leadership explicitly stated that there is currently no strategic necessity to hold Bitcoin on the company’s balance sheet. The company emphasized that its existing cash management policies and liquidity frameworks are sufficient to meet operational and growth objectives. The board’s official stance was that Bitcoin’s inherent volatility and regulatory uncertainties do not align with Meta’s conservative treasury strategy.

Historically, other tech giants such as Microsoft and Amazon have also rejected similar proposals, favoring traditional, less volatile assets. This conservative approach underscores a broader industry trend where major corporations prefer stability and regulatory clarity over the potential gains of digital assets.

Why Institutional Investors Remain Wary of Bitcoin

1. Persistent Volatility Concerns

One of the primary barriers to widespread institutional adoption is Bitcoin’s price volatility. Despite a remarkable 130% increase over the past year, the cryptocurrency has experienced significant price swings, including a 70% decline in 2022. Such fluctuations make many corporate treasurers hesitant to include Bitcoin in their reserves, preferring assets with more predictable returns.

Bitcoin’s daily return standard deviation exceeds 4%, vastly surpassing the less than 0.5% typical deviation seen in U.S. Treasuries. For companies prioritizing financial stability, this level of unpredictability remains a critical concern.

2. Regulatory Ambiguity

Although recent developments, such as the launch of U.S. Bitcoin ETFs in early 2024, have added some stability to the asset class, regulatory clarity remains elusive. The IRS and SEC continue to refine their frameworks for crypto assets, creating an environment of uncertainty that complicates compliance and reporting for corporations.

3. Conservative Financial Policies Dominate

Many large tech firms adhere to conservative treasury policies, avoiding risky or untested assets unless regulatory and market conditions are fully established. This cautious stance reflects a broader industry pattern where stability and risk mitigation take precedence over speculative gains, even if the latter could potentially enhance long-term value.

Industry-Wide Trends: A Conservative Outlook

Meta is not alone in its cautious approach. Over the past two years, shareholder proposals advocating for Bitcoin holdings have been consistently rejected by companies like Amazon and Microsoft. Similarly, industry leaders such as Apple, Alphabet, and Nvidia continue to avoid including digital assets on their balance sheets.

Since Tesla’s landmark purchase of $1.5 billion in Bitcoin in 2021, the company has gradually divested some of its holdings, maintaining a relatively modest position today. Despite Bitcoin’s current valuation nearing $1.5 trillion, most institutional players remain reluctant to treat it as a standard treasury asset, highlighting ongoing concerns about market stability and regulatory risks.

Market Response and Industry Outlook

The recent shareholder vote did not significantly impact Bitcoin’s market price, which remained steady at around $68,200. This stability suggests that investors had already anticipated the outcome, and the broader market continues to view Bitcoin as a speculative but potentially rewarding asset.

Crypto industry experts note that while Meta’s decision aligns with traditional corporate caution, it also underscores the ongoing divide within the industry. Advocates argue that the conservative approach may cause companies to miss out on substantial long-term gains, as Bitcoin has appreciated over 5,000% since Meta’s IPO in 2012, outperforming most conventional financial instruments.