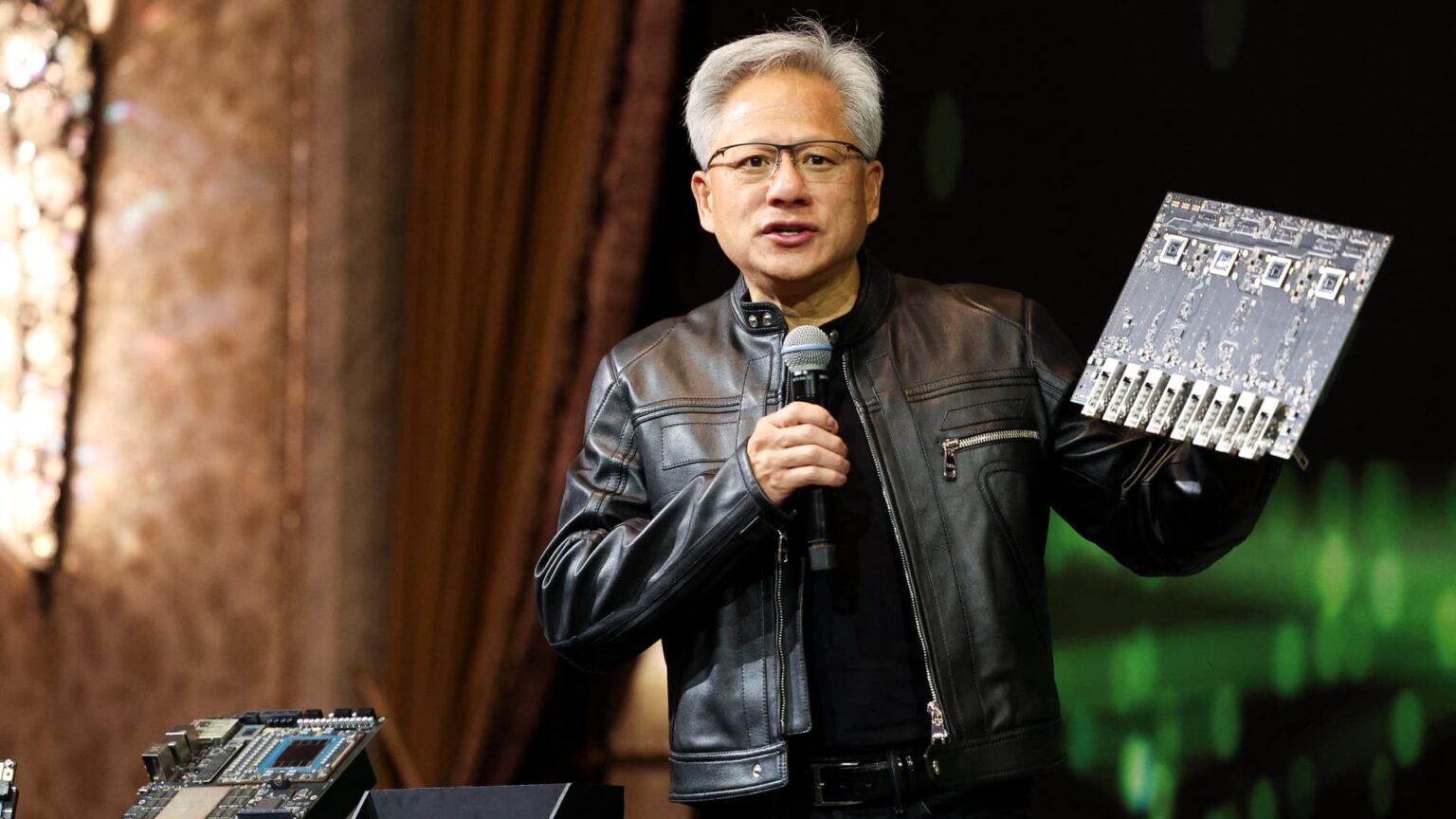

Nvidia’s Strategic Challenges and Market Outlook Amid U.S.-China Tensions

CEO Jensen Huang Highlights Revenue Losses Due to China Restrictions

Nvidia’s recent financial performance has sparked both optimism and concern among investors and industry analysts. While the company reported a robust 69% year-over-year increase in revenue, reaching $44 billion in the first quarter of the fiscal year-surpassing expectations-its CEO Jensen Huang openly acknowledged the significant hurdles posed by U.S. export restrictions on China. Huang revealed that the company is incurring billions of dollars in losses because it cannot sell its products in the Chinese market, which traditionally accounts for approximately $50 billion annually.

“The $50 billion China market is effectively closed to U.S. companies,” Huang stated during the earnings call. “Consequently, we are writing off billions of dollars worth of inventory that we cannot sell or repurpose.”

Impact of Export Controls on Nvidia’s Business and Future Prospects

Despite the setback in China, Nvidia’s overall financial health remains strong. The company’s quarterly revenue exceeded forecasts, driven by demand in other regions and sectors. However, the restrictions have led to a significant inventory write-down of $4.5 billion, reflecting unsellable stock accumulated due to the export bans. Additionally, Nvidia had approximately $8 billion worth of pending orders for its H20 AI chips, which now must be canceled, further impacting revenue projections.

The company’s guidance for the upcoming quarter anticipates revenues of around $45 billion-an 18% decrease from potential figures if the export restrictions had not been imposed. This shortfall underscores the broader impact of U.S. policies on the global semiconductor industry.

U.S.-China Tech Tensions and Nvidia’s Strategic Response

The U.S. government’s tightening export controls are rooted in national security concerns, particularly regarding the proliferation of advanced AI chips to China, which is seen as a strategic competitor. In April, the Biden administration mandated that Nvidia obtain an export license for its H20 AI processor intended for China-a move that effectively halted sales without any grace period. This decision followed restrictions introduced in 2022, which aimed to limit China’s access to cutting-edge AI technology.

Huang emphasized that these export controls are not only affecting Nvidia but are also impacting the broader U.S. technology ecosystem. He pointed out that China is unlikely to halt its AI development efforts, regardless of restrictions, and will instead turn to domestic companies like Huawei to develop their own chips and AI capabilities.

“The assumption that China cannot produce AI chips is flawed,” Huang remarked. “They already have the capacity, and the restrictions only accelerate their efforts to become self-sufficient.”

The Broader Geopolitical Context and Nvidia’s Position

While Huang has been vocal about the challenges posed by U.S. export policies, he remains cautious in criticizing the Trump administration, recognizing the complex political landscape. He expressed appreciation for the rescinding of the so-called “AI diffusion” rules, which would have imposed global AI chip quotas, and praised the administration’s efforts to foster international deals, such as those with Saudi Arabia and the United Arab Emirates, to establish data centers in the Middle East.

Nvidia is also committed to maintaining its manufacturing base within the United States, aligning with the national strategy to bolster domestic high-tech production. Huang stated:

“We share the vision of advanced, automated manufacturing stateside, and we are building our latest chips and systems on U.S. soil.”

However, when asked about developing China-specific chips or seeking exemptions from current restrictions, Huang clarified that no such alternatives are currently in development, citing the stringent nature of existing U.S. policies.

“There is no substitute product at this moment,” Huang confirmed. “The president has a plan and a vision, and I trust his leadership.”

The Future of AI and Geopolitical Implications

Huang’s comments reflect a broader industry concern: the intersection of technological innovation and geopolitical strategy. As China continues to advance its AI capabilities independently, the global landscape of AI development is becoming increasingly fragmented. Industry experts warn that restrictions could slow innovation in the short term but may also catalyze China’s efforts to develop self-reliant AI ecosystems.

In the context of national security, experts like Byron Deeter from Bessemer Venture Partners emphasize the importance of safeguarding AI technology, noting that the development of secure, domestically produced AI chips is critical for maintaining technological sovereignty.

Conclusion: Navigating a Complex Global Tech Environment

Nvidia’s experience underscores the delicate balance between innovation, national security, and international trade policies. While the company continues to demonstrate resilience and growth, the ongoing U.S.-China tensions pose significant strategic challenges. As the global AI race accelerates, companies like Nvidia must adapt to a landscape where geopolitical considerations increasingly influence technological progress and market access.

Note: The current geopolitical climate and technological developments are rapidly evolving. Stakeholders should stay informed about policy changes and industry trends to navigate this complex environment effectively.