Senate Approves Controversial Tax and Immigration Legislation in Narrow Vote

In a closely contested session on Tuesday, the Senate narrowly passed a sweeping package of tax reforms and immigration policies, a move that Republicans envision as a defining achievement for President Donald Trump’s potential second term. The legislation signals a significant shift in federal priorities, aiming to reshape government functions and roll back many initiatives introduced by the Biden administration.

Decisive Vote and Key Provisions

Vice President JD Vance cast the decisive tie-breaking vote after more than five hours of debate, following nearly 48 hours of continuous reading, discussion, and amendments on the Senate floor. The bill extends substantial tax cuts initiated during Trump’s first term, including new promises such as abolishing income taxes on tips and overtime earnings. It also allocates hundreds of billions of dollars toward strengthening immigration enforcement and bolstering national defense.

To fund these initiatives, the legislation proposes significant reductions-approximately $1 trillion-from Medicaid, the federal health program serving low-income populations and individuals with disabilities. Additionally, it envisions cuts to SNAP (Supplemental Nutrition Assistance Program), formerly known as food stamps. According to the Congressional Budget Office, nearly 12 million Americans could lose healthcare coverage if the bill becomes law.

Internal Republican Divisions and Opposition

The bill’s passage exposed deep divisions within the Republican ranks. Some senators advocated for more aggressive spending cuts, while others expressed concern over the proposed reductions to Medicaid and other social programs. Notably, three Republican senators-Rand Paul (Kentucky), Thom Tillis (North Carolina), and Susan Collins (Maine)-voted against the measure, citing concerns over fiscal responsibility and social safety net impacts.

Legislative Journey and Political Dynamics

Senator Vance’s vote was pivotal, arriving early in the morning and casting the deciding ballot in the evening. The legislative process was intense, with lawmakers engaging in extensive floor debates and amendments. Senator Paul warned that some conservatives might regret supporting the bill, emphasizing the potential long-term consequences of the legislation.

The next step involves approval from the House of Representatives, where many members have expressed reservations about the Senate’s modifications. President Trump has set a deadline of Independence Day for the bill’s passage, urging swift action.

House of Representatives’ Response and Challenges

House leadership, led by Speaker Mike Johnson (R-Louisiana), has pledged to expedite the bill’s consideration, asserting that it aligns with President Trump’s agenda. In a joint statement, House Republicans declared their readiness to pass the legislation and deliver it to the president’s desk in time for the holiday.

However, fiscal conservatives within the House have voiced serious concerns. Representative Ralph Norman (R-South Carolina), a member of the influential Rules Committee and the House Freedom Caucus, criticized the bill for deviating from the original conservative principles, stating, “This version doesn’t reflect what the president wanted and is a nonstarter.”

Shifts in Senate Support and Key Votes

Several senators who initially opposed the bill later changed their stance. Senator Lisa Murkowski (R-Alaska), citing concerns over Medicaid cuts, ultimately voted in favor after receiving additional concessions, including increased funding for rural hospitals and delayed SNAP reductions for high-poverty states. Murkowski described her decision as “agonizing” and expressed hope that the House would amend the bill further to mitigate social program cuts.

Other notable votes included Senators Thom Tillis and Susan Collins, who opposed the legislation, while Senator Rand Paul’s opposition was rooted in concerns over insufficient spending reductions. The bill’s passage was also supported by Senator Lisa Murkowski, who emphasized the importance of balancing benefits with fiscal responsibility.

Policy Highlights and Economic Impact

The legislation features several measures aimed at benefiting working families, such as increasing the child tax credit, providing a bonus to seniors’ standard deduction, and establishing savings accounts for newborns funded with $1,000 of taxpayer money. It also proposes allowing individuals purchasing American-made vehicles to deduct up to $10,000 in car loan interest.

Despite these populist elements, critics argue that the bill is fundamentally regressive. The Congressional Budget Office estimates that the lowest 10 percent of households could see an average decrease of $1,600 in benefits, while the wealthiest 10 percent could gain approximately $12,000. The bill also makes permanent certain corporate tax deductions, encouraging business investments but potentially widening income inequality.

National Security and Fiscal Implications

The legislation allocates nearly $170 billion for border security and immigration enforcement, marking one of the largest investments in homeland security in recent history. An additional $160 billion is designated for the Department of Defense, including funding for Trump’s proposed “Golden Dome” missile defense system.

The increased spending and tax cuts are projected to add nearly $4 trillion to the national debt over the next decade. To facilitate the legislative process, Republicans have temporarily relaxed the Senate’s filibuster rules, a move that could complicate efforts to manage the country’s mounting fiscal challenges.

Debt Ceiling and Future Outlook

The bill also proposes raising the debt ceiling by $5 trillion, a move aimed at preventing a potential government default during Trump’s presidency. However, some senators, like Rand Paul, have voiced opposition to large debt increases, advocating for smaller, incremental raises tied to spending cuts.

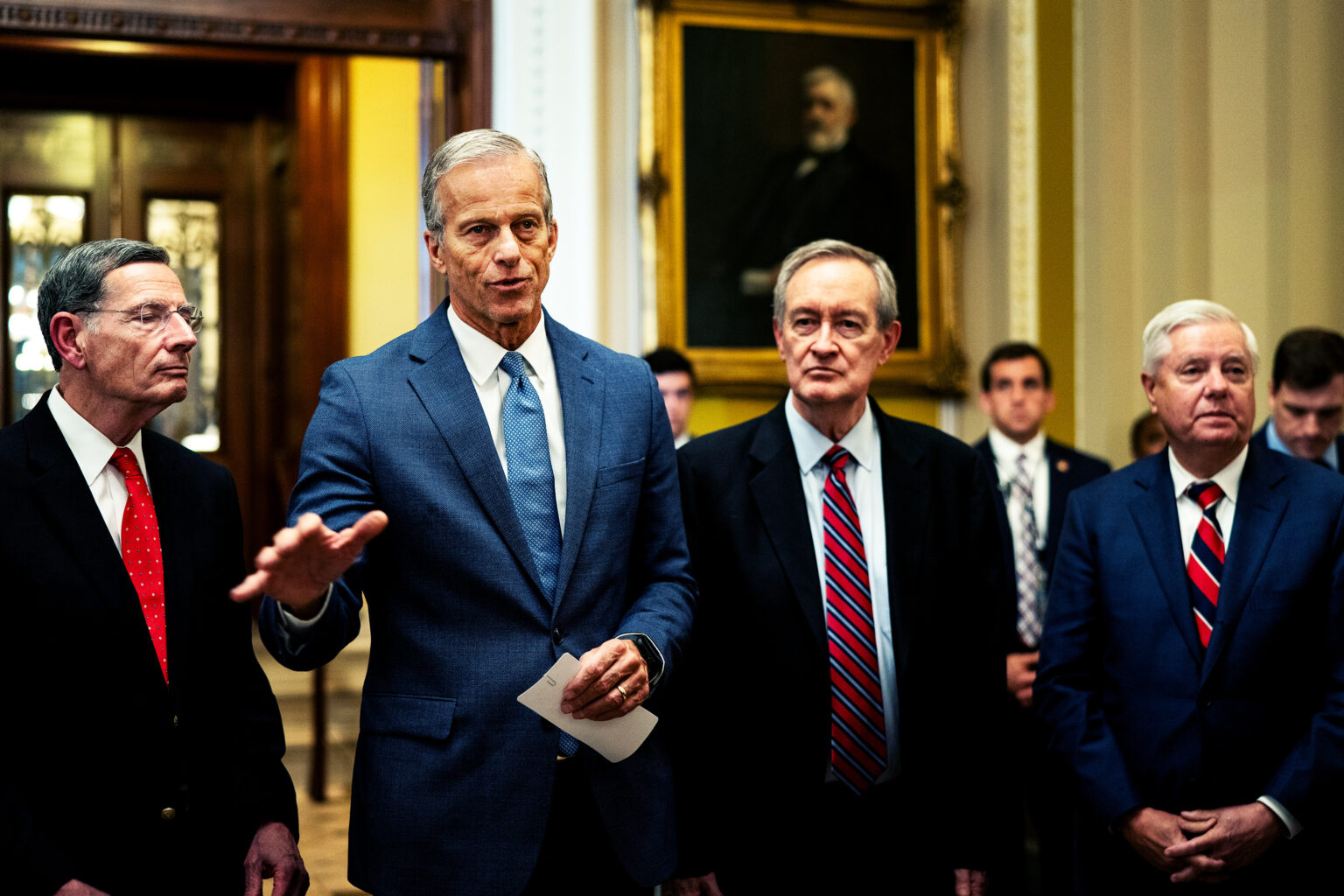

Senator Thune highlighted the party’s broader goal of reducing deficits, though others, like Senator Ron Johnson, argued that the bill’s increased costs and spending levels were excessive. The legislative journey remains uncertain, with ongoing negotiations and potential amendments expected in the coming weeks.

Conclusion: A Divisive but Pivotal Legislation

This legislation represents a significant shift in U.S. fiscal and immigration policy, reflecting the priorities of the current administration and Republican leadership. While it aims to deliver on campaign promises and bolster certain economic sectors, critics warn of its long-term implications for income inequality and national debt. As the bill moves to the House, the coming days will determine whether it can garner enough support to become law before the Independence Day deadline.