Bitcoin’s Urgency in a Financial System on the Brink

During the Bitcoin 2025 conference, Lyn Alden delivered a compelling presentation that underscored the urgent need for alternative financial solutions. Her data-driven insights painted a clear picture: the United States’ economic framework is losing its grip, and Bitcoin emerges as a vital safeguard in this turbulent landscape.

Decoupling of Economic Indicators Signals Crisis

Using data from the Federal Reserve’s FRED database, Alden highlighted a troubling divergence: while unemployment rates have decreased, the national deficit has ballooned to over 7% of GDP. “This trend began around 2017, accelerated during the pandemic, and shows no signs of reversing,” she explained. “We are witnessing a paradigm shift-this isn’t business as usual.”

The Financial Train Has No Brakes

Alden was unequivocal in her assessment. “The financial system is now akin to a train without brakes-its stopping mechanisms are severely compromised.” She emphasized that traditional controls are no longer effective, leaving the economy vulnerable to uncontrollable debt escalation.

Why Bitcoin Remains a Critical Asset

For investors and enthusiasts, Alden explained why Bitcoin continues to be a vital asset. “It’s scarce, decentralized, and capped by strict mathematical rules,” she noted. She pointed to a recent comparison between gold and fiat currencies, illustrating how gold prices surged as interest rates plummeted. “Five years ago, many believed Bitcoin couldn’t thrive in a high-interest-rate environment. Today, Bitcoin surpasses $100,000, gold hits new highs, and banks are under immense stress,” she observed.

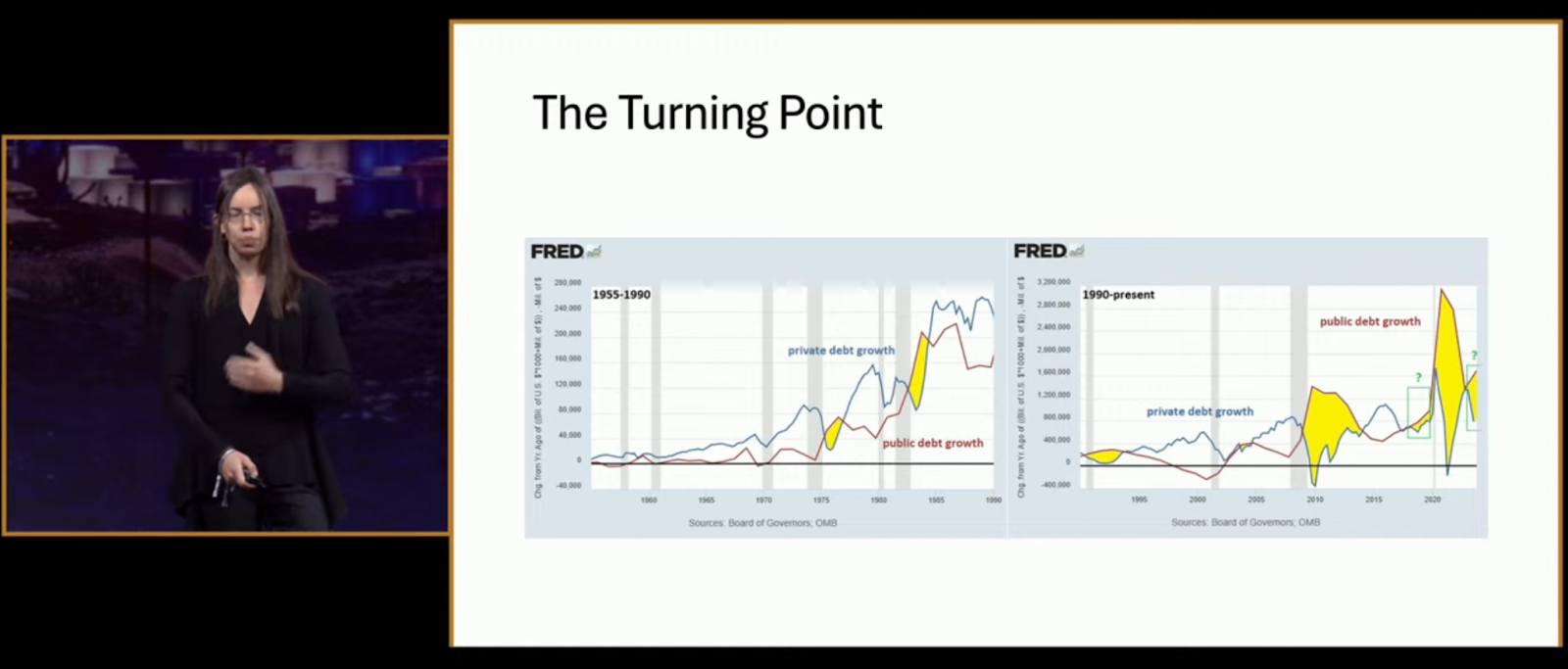

The Shift in Debt Dynamics

Next, Alden introduced a pivotal chart illustrating a fundamental change: post-2008, public debt growth has overtaken private sector debt, reversing a long-standing trend. “This shift fuels inflation and indicates that the Federal Reserve can no longer simply tighten monetary policy to control the economy,” she explained.

The Rising Cost of Interest and Its Impact on the Deficit

Another revealing chart demonstrated how increasing interest rates are accelerating the federal deficit. “Higher rates cause the interest payments to skyrocket, making the debt unsustainable,” Alden said. “The system’s brakes are completely gone-raising rates only worsens the problem by increasing the debt burden faster than it can be managed.”

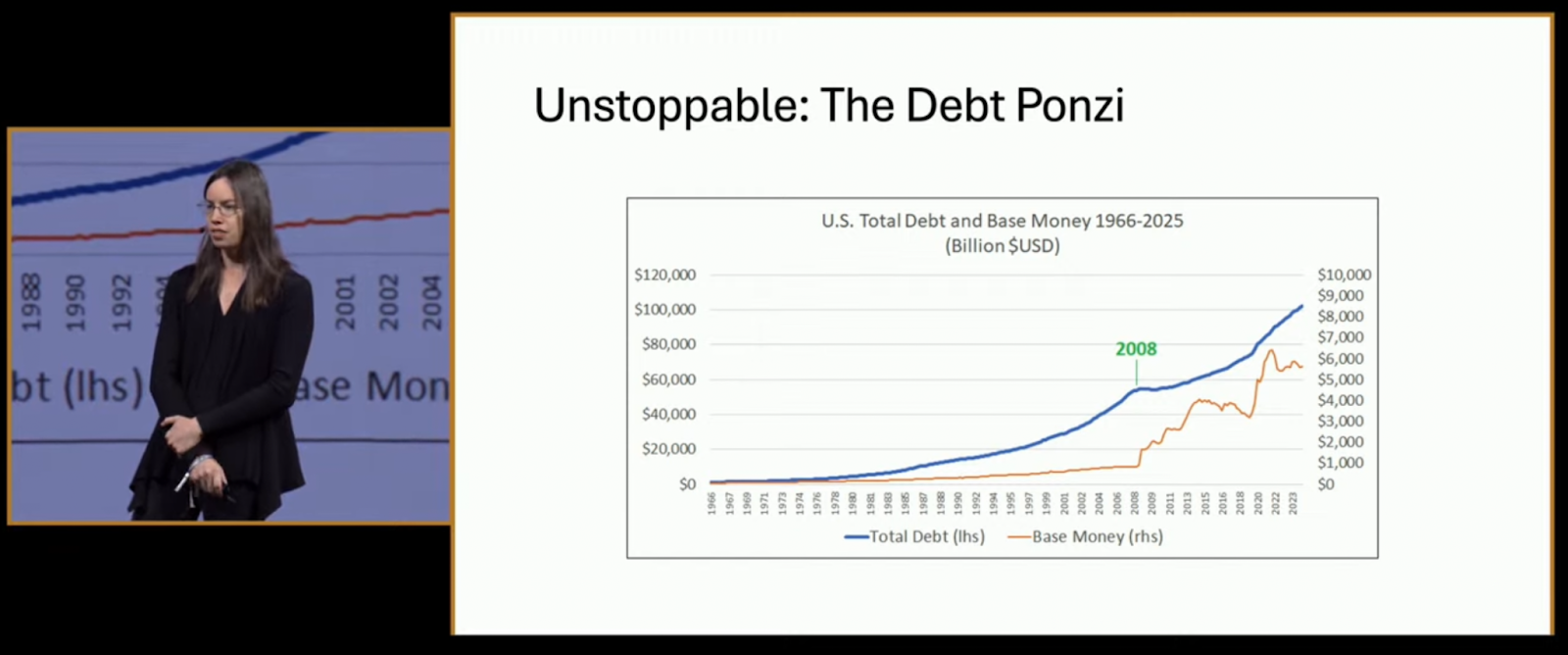

The System’s Fragile Foundation: A Ponzi Analogy

She likened the current financial setup to a Ponzi scheme: “The entire system relies on continuous growth. Like a shark that must keep swimming to survive, the economy cannot afford to pause or it risks collapse.”

Debt Accumulation: An Unstoppable Trend

Alden pointed out that total debt relative to the money supply has been steadily rising, with only brief interruptions during the 2008 financial crisis and the post-2020 economic stimulus. “This upward trajectory is relentless-there’s no turning back,” she emphasized.

Bitcoin: The Antidote to Systemic Instability

Given this bleak outlook, Alden concluded that Bitcoin stands out as a resilient alternative. “Its scarcity, decentralization, and fixed supply make it uniquely resistant to the flaws of the current system,” she stated. “Mathematics and human nature are the only forces capable of stopping Bitcoin-and they are precisely why it offers the best protection against systemic collapse.”

Stay Informed: Full Panel Discussion and Conference Highlights

For those interested in a deeper dive, the complete panel discussion and additional insights from the Bitcoin 2025 event are available below: