The landscape of cryptocurrency trading in India has been rapidly transforming since its emergence, often progressing quietly but with significant shifts-particularly with the rise of crypto derivatives. As the number of traders and their expertise levels expand, it becomes evident that derivatives such as futures, options, and perpetual swaps are no longer exclusive to institutional investors. Instead, retail traders, high-frequency traders, and hedgers are increasingly leveraging these financial instruments to enhance their trading strategies.

India’s crypto derivatives sector holds immense potential, yet it faces persistent hurdles-regulatory ambiguities, technological challenges, and educational gaps. Despite this complexity, one platform is carving out a distinct identity through a product-centric and compliance-focused approach-Delta Exchange.

In this article, we will explore the future trajectory of crypto derivatives in India and examine how Delta Exchange is positioning itself as a catalyst in this evolving market.

Understanding Crypto Derivatives and Their Significance

Source | Investment Trends in Crypto Derivatives

Crypto derivatives are financial contracts whose value is derived from an underlying cryptocurrency asset. Instead of directly purchasing digital currencies like Bitcoin or Ethereum, traders speculate on their price movements through various contractual instruments such as:

- Futures – Agreements to buy or sell an asset at a predetermined price on a future date.

- Perpetual swaps – Similar to futures but without an expiry date, allowing indefinite trading periods.

- Options – Contracts granting the right, but not the obligation, to buy or sell at a specified price before a certain date.

Market participants utilize these instruments for hedging, leveraging positions, capital efficiency, and volatility trading. The growing awareness and accessibility of such products in India have led to a surge in demand, especially as traditional markets face increased uncertainty, making crypto derivatives an attractive avenue for alpha generation.

Market Opportunities in India’s Crypto Derivatives Sector

According to The Financial Times, digital payment transactions in India skyrocketed from approximately ₹2,071 crore in FY 2017-18 to an estimated ₹18,737 crore in 2023-24, reflecting a compound annual growth rate (CAGR) of around 44%. This rapid digital adoption positions India among the top countries globally for crypto engagement, driven by a tech-savvy population and a steadily digitizing financial ecosystem. This environment creates fertile ground for derivatives trading to flourish, supported by several key factors:

- INR-Based Trading Platforms

Delta Exchange stands out as one of the few platforms offering crypto trading directly in Indian Rupees (INR). This eliminates the need for converting to stablecoins like USDT, simplifying onboarding, reducing transaction costs, and making profit and loss tracking more straightforward for Indian traders.

- Favorable Regulatory Climate

Platforms like Delta Exchange, registered with India’s Financial Intelligence Unit (FIU), are paving the way for a more legitimate and transparent derivatives market. This registration reassures both retail and institutional investors that they are operating within a compliant framework aligned with Indian regulations.

- Growing Demand for Advanced Trading Tools

As Indian traders evolve from basic buy-and-hold strategies, their appetite for sophisticated derivatives such as options combinations, move contracts, and multi-leg strategies increases. Platforms like Delta Exchange cater to this demand by offering a comprehensive suite of advanced trading options.

- Financial Inclusion and Youth Engagement

India’s digitally native youth, primarily mobile-first users, are increasingly participating in crypto markets. User-friendly apps and educational resources provided by platforms like Delta Exchange are encouraging broader participation among young investors. Mobile trading apps are readily available on Google Play and the App Store, making access even easier.

Challenges to Overcome for Sustainable Growth

While prospects are promising, several obstacles must be addressed to realize the full potential of crypto derivatives in India:

- Regulatory Ambiguity

Despite the existence of the FIU and some regulations, India’s legal framework for cryptocurrencies remains incomplete. This uncertainty hampers institutional confidence and stifles product innovation.

- Risks of Excessive Leverage and Market Manipulation

Source | The danger of leverage wiping out retail traders’ investments underscores the need for responsible trading practices. Many traders unfamiliar with the intricacies of derivatives risk significant losses, especially when high leverage is involved.

- Banking Infrastructure Challenges

Efficient INR on-ramps and off-ramps require seamless integration with banking systems. Disruptions or delays in banking infrastructure can hinder trading activity and liquidity.

- Global Competition

Major international exchanges like Binance and OKX maintain a strong presence in India, often operating discreetly. Local platforms must differentiate themselves through trust, transparency, and regulatory compliance to compete effectively.

Delta Exchange’s Role in Shaping the Future

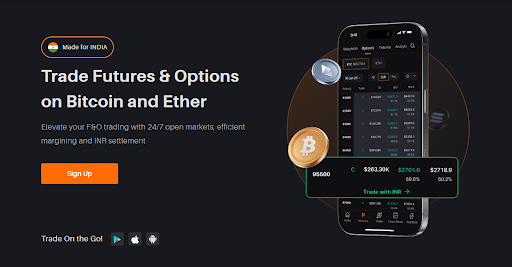

Source | Delta Exchange: A Regulatory-Compliant, INR-First Crypto Derivatives Platform

As the Indian crypto ecosystem matures, Delta Exchange is positioning itself as more than just a trading platform-it aims to be a launchpad for the next generation of traders. Its strategic focus on compliance, innovation, and user-centric features sets it apart:

Prioritizing Regulation and Innovation

Delta Exchange is among the few Indian crypto platforms registered with the FIU, demonstrating a strong commitment to regulatory adherence and KYC/AML standards. This credibility fosters trust among users and aligns with evolving regulatory expectations.

Comprehensive Derivatives Offerings

The platform provides a broad spectrum of derivatives beyond simple futures, including:

- Perpetual swaps across major cryptocurrencies and altcoins

- Options trading on BTC, ETH, and other tokens

This extensive product suite makes Delta Exchange a one-stop shop for advanced crypto trading in India.

INR-First Trading Experience

The platform’s INR-centric approach allows traders to deposit, trade, and withdraw in Indian Rupees without converting to stablecoins, streamlining the user experience and reducing costs.

Robust Infrastructure and Security

Delta Exchange offers high liquidity, rapid execution, and minimal slippage, catering to retail traders, institutional clients, and high-frequency trading firms alike. Security features include:

- Cold storage of funds

- Two-factor authentication (2FA)

- Manual withdrawal verification

Educational Resources and Risk Management

To empower traders, Delta Exchange provides a risk-free demo mode, comprehensive educational content, and advanced charting tools, enabling informed decision-making without risking real capital.

Emerging Trends and Future Outlook

As India’s regulatory landscape stabilizes and institutional interest deepens, several developments are anticipated:

- Introduction of structured products and tailored derivatives

- Potential launch of regulated crypto ETFs

- Integration of AI-driven trading pools within retail platforms

- Increased participation from hedge funds and asset managers

- Expansion of educational initiatives and global outreach by platforms like Delta Exchange

Summary: A Bright Horizon for Crypto Derivatives in India

The outlook for crypto derivatives in India is optimistic, driven by market maturation, regulatory clarity, and technological innovation. The demand for platforms that combine safety, advanced features, and regulatory compliance is higher than ever.

Delta Exchange exemplifies this evolution-offering a comprehensive suite of derivatives, an INR-first trading model, registered compliance, and a focus on trader education. It is poised to lead India’s next wave of crypto adoption, serving as a trusted platform for both retail and institutional investors.

For those eager to explore the high-potential realm of crypto derivatives with confidence, Delta Exchange stands out as a reliable and forward-looking partner.

Disclaimer: Trading cryptocurrencies involves significant risk and may not be suitable for all investors. Market prices are highly volatile and subject to rapid changes. Investors should conduct thorough research and consult licensed financial advisors before making any investment decisions. Delta Exchange operates in accordance with Indian regulations and is registered with the Financial Intelligence Unit (FIU) of India.